Rail Vikas Nigam Ltd IPO - Should you subscribe?

On March 13, 2019, Kolkata based PSU MSTC Ltd debuted in the primary market with its Rs. 226.18 Crore IPO. I don't know the Nakshtra in which this IPO was launched that it received a super lame response from the investors. The IPO was launched with a lot of expectations but miserably failed to attract the investors. It seems that investors have lost the faith in PSUs. Due to poor subscription figures, the closure date had to be extended by a couple of days. On March 22, 2019, finally, the issue managed to subscribed by 1.46 times. The share is yet to be listed on the bourses and the fate is yet to be unraveled on March 29, 2019. The vibes are negative and the share is expected to be listed at discount. If you are allotted the shares, just fold your hands and pray to God. You don't have any choice either, LOL!

The Government Of India has been struggling to achieve it's 2018-19 disinvestment target of Rs. 80,000 Crore. Due to Lok Sabha election round the corner and poor performance of IRCON International (Railway PSU) in the recent past, investors are not ready to take the chance. They are already shaken up. So, they are not showing much interest in PSU stocks.

After Hindustan Aeronautics Ltd, Bharat Dynamics Ltd and many more PSU IPOs failures in the last 18 months, I've stopped applying in any PSU IPOs. I love Modi Government Administration but I don't love PSU IPOs anymore, LOL! It's always better to lose the opportunity, than to lose the capital.

After Hindustan Aeronautics Ltd, Bharat Dynamics Ltd and many more PSU IPOs failures in the last 18 months, I've stopped applying in any PSU IPOs. I love Modi Government Administration but I don't love PSU IPOs anymore, LOL! It's always better to lose the opportunity, than to lose the capital.

In June 2018, MoR's RITES Ltd came up with its IPO. The IPO got overwhelming response from the investors of all categories. It subscribed by 66 times, I think the IPO was launched in some divine Nakshatra. On the listing day also, it spread only joy to its investors. The share listed with a bang and has given commendable returns to the investors so far. On March 26, 2019, the share was trading at 36% premium to its issue price.

Then, in September 2018, IRCON International debuted with the same Josh. However, the Josh died down soon. Though it received a moderate response from the investors, on listing day, it disappointed its investors. The share listed at discount to its issue price. Even today, seven months down the line, the share has not managed to reach to its original issue price i.e. Rs. 475 (at upper band). As on March 26, 2019, the share is trading at Rs. 400 i.e. 16% discount to its issue price. I applied none of both. In one I lost the opportunity, in second I saved the capital. SMART!

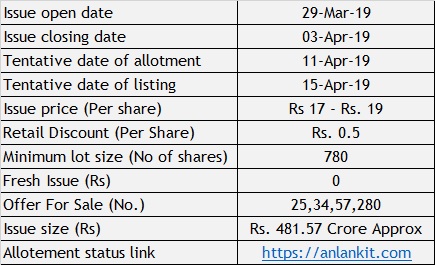

In this turbulent scenario, the GoI is coming up with its yet another, a Miniratna (Category - I) Scheudule "A" PSU IPO under Ministry of Ralway. The ministry has rolled up its sleeves to garner as much as 481.57 Crore through Rail Vikas Nigam Ltd IPO. It's Ministry of Railways' third IPO in 2018-19.

Issue Details:

Overview:

Incorporated in January 2003 as a project executing agency working for and on behalf of MoR. The company was incorporated with the objective to undertake rail project development, mobilization of financial resources and implementation of rail projects pertaining to strengthening of golden quadrilateral and port connectivity and raising of extra- budgetary resources for project execution. However, in 2004, the MoR decided that the Company should restrict itself to project execution. The role of the Company for mobilization of finances is restricted to forming of project specific SPVs with private participation.

The company is in the business of executing all types of railway projects including new lines, doubling, gauge conversion, railway electrification, metro projects, workshops, major bridges, construction of cable stayed bridges, institution buildings etc.

The company generally works on a turnkey basis and undertake the full cycle of project development from conceptualization to commissioning including stages of design, preparation of estimates, calling and award of contracts, project and contract management, etc. and all stages of project execution upto the stage of commissioning of the new railway lines.

Objective of the issue:

The issue is 100% Offer For Sale by the existing shareholder - The President of India acting through the Ministry of Railways. The company will not receive any proceeds from the Offer and all such proceeds will go to the selling shareholder. The objective is to achieve the benefit of listing the Equity Shares on the stock exchanges.

Pricing of the issue:

The company has set the price range between Rs. 17 - Rs. 19 per share. The EPS as on March 31, 2018 was Rs. 2.73 per share (Diluted on consolidated basis). At upper and lower price band, the PE ranges between 6.23 - 6.96. The pricing seems quite reasonable. They have to keep the price reasonable to attract the investors. 50 paisa per share discount is offered to retail investors.

The consolidated NAV (Net Asset Value) /Book value as on March 31, 2018 was Rs. 18.83. At upper and lower price band, PB ratio ranges between 0.90 - 1.01. That means, the pricing set is one time of its NAV. From this angle also, the pricing is quite reasonable.

Peer Comparison:

Based on public companies whose business profile is comparable to the company's business, IRCON International Ltd is the only relevant listed company in the industry in which the company operates. IRCON International Ltd had a P/E Ratio of 9.50 computed based on closing market price as on February 28, 2019 as available at BSE website divided by Basic EPS for FY 2018 as available in the prospectus of IRCON International Limited dated September 20, 2018.

Financials

You can not deny the fact that the company has established a consistent track record of financial performance and growth. The revenue from operations on consolidated basis for the Financial Year 2016, Financial Year 2017 and Financial Year 2018 and the six month period ended September 30, 2018 aggregated to Rs. 4,539.85 Crore, Rs. 5,915.11 Crore, Rs. 7,597.36 Crore and Rs. 3,622.88 Crore, respectively. The revenue from operations has increased at a CAGR of 29.36%

The net profit was Rs. 429.02 Crore, Rs. 443.09 Crore, Rs. 569.36 Crore and Rs. 253,64 Crore, respectively, for the same periods. The net profit has increased at a CAGR of 15.20% .

The EBITDA for Financial Year ended March 31, 2016, March 31, 2017 and March 31, 2018 and the six month period ended September 30, 2018 was Rs. 526.76 Crore, Rs. 583.77 Crore, Rs. 713.53 Crore and Rs. 333.36 Crore respectively.

Order Book

Since its inception in 2003, MoR has transferred 179 projects to the company of which 174 projects are sanctioned for execution. Out of these, 72 projects have been fully completed totaling to Rs. 20,567.28 Crore and the balance are ongoing. The company has an order book of Rs. 77,504.28 as on December 31, 2018 which includes 102 ongoing projects.

DO NOT judge any PSU by its order book. No matter how much order book it shows, you never know how much actual work they are going to get from the Government. Defense PSUs viz. Hindustan Aeronautics Ltd and Bharat Dynamics Ltd had also given impressive order book in RHP, but they are not getting sufficient order. The shares of both companies are bleeding. Both the companies were cash rich and high dividend paying, but now the dividend is also no where. I believe PSU Order book is irrelevant. If 2019 Lok Sabha election changes the Government, then only God knows what happens to order book.

The company's major client is Indian Railways. The other clients include various central and state government ministries, department and public sector undertakings.

Debt/Equity Ratio

The total debt equity ratio was 0.59 as on September 30, 2018 and the long term debt/equity ratio was 0.48 on that date.

Dividend:

The company has been paying dividend consistently. In PSUs, the Government decides how much dividend to be declared rather than Managing Director of the company. As and when the Government needs money, it pushes all its PSUs to declare the dividends. However, Rail Vikas Nigam Ltd has declared low dividend in the last five years except in 2017.

Conclusion:

The company is majorly dependent on MoR for sourcing its projects. Also, it depends on MoR for funds and manpower supply. The business is substantially affected by prevailing economic, political and other prevailing conditions in India. After all, it's a Government Company.

On the other hand, the company has given an impressive financial performance in the last five years. The management is good. The company has been consistently paying the dividend. And on top of it, it has kept the price much reasonable.

I am NEUTRAL in this IPO. In case you want to apply, then you should see the anchor investor list first. If LIC in it with a huge chunk, then AVOID this IPO. LIC bails out PSU IPOs. If other anchor investors are showing the interest, then first two days subscription figures can be monitored and then call can be taken to apply.

Thank you for reading...Jai Hind...enjoy and love your soldiers...

(Note : Please note that I write reviews based on my knowledge and understanding. The reader of this article should do his/her own research before taking any decision)

Comments

Post a Comment