Varroc Engineering Ltd IPO - Should you subcribe?

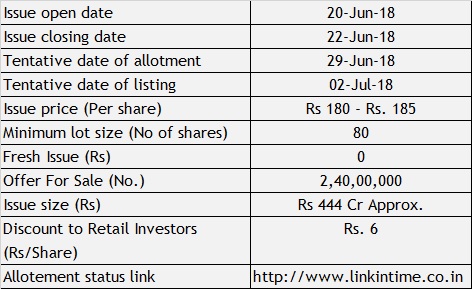

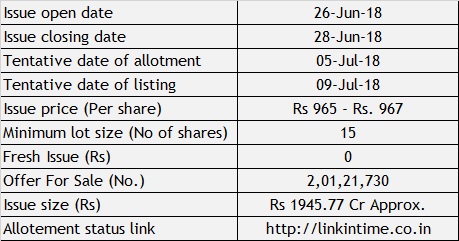

June' 2018 has witnessed that IPO market has been picking up its momentum. In April'2018, there was not a single mainstream IPO. In May'2018, IndoStar Capital Finance inaugurated Fiscal 2019 IPO market. The company got good response but failed to give sound listing gain. It listed with meagre premium and went down to below its issue price. Presently, the share is trading at 4% discount to its issue price. In June 2018, Government PSU RITES Ltd and oleochemical based additives manufacturer Fine Organic Industries Ltd came up with their IPOs. They too have succeeded to get good response in the market. They have registered good subscription figures. However, results are yet to be seen. The listing day will establish the real success or failure for the investors. There may not be much listing gain but both shares are fundamentally strong and wealth creators in long term. Now, yet another IPO is going to hit the primary market in the last week of June'18. Inco