IRCTC IPO - Should you subscribe?

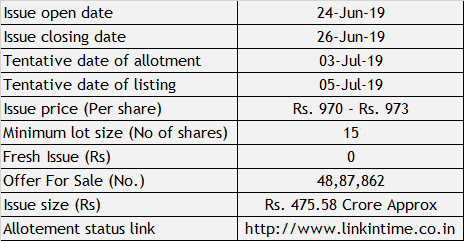

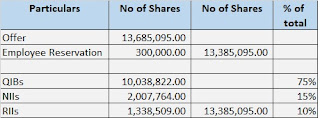

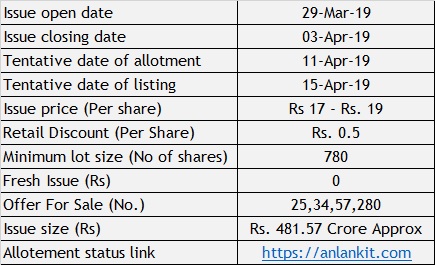

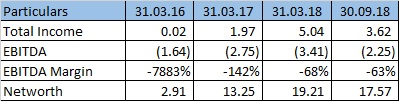

Incorporated in September 1999, "Indian Railway Catering and Tourism Corporation Limited" - a wholly owned Government company under the administration of Ministry of Railways has come up with its IPO. This is the fourth company under the MoR going public. RITES Ltd was the first who went public in June 2018 followed by Rail Vikas Nigam Limited in September 2018 and Ircon International in April 2019. Out of these three, except Ircon, RITES Ltd and Rail Vikas Nigam Limited are trading at premium to its issue price as on September 27, 2019. Ircon has disappointed its investors. This company is the only entity authorized by Indian Railways to provide catering services to railways, online railway tickets and packaged drinking water at railway stations and trains in India. The company was incorporated with the objective to upgrade, modernize and professionalize catering and hospitality services, managing hospitality services at railway stations, on trains and other loca