HDFC Standard Life Insurance Company Limited IPO - Should you subscribe?

IPO Overview:

HDFC and Standard Life Mauritius promoted company HDFC Standard Life is going to hit the primary market on November 7,2017 with Rs. 8245.27 - Rs. 8695 Crore IPO. The issue closes on November 9,2017. The tentative dates of allotment and listing are November 15, 2017 and November 17,2017 respectively. The allotment status can be seen on http://karisma.karvy.com. The company has set price range between Rs.275 - Rs.290 per share and minimum application lot is for 50 shares.

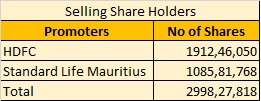

HDFC Standard Life IPO is a 100% Offer For sale. The existing shareholders shall sell 29,98,27,818 shares.

Out of 29,98,27,818 shares, 21,44,520 shares are reserved for HDFC Life employees, 8,05,000 shares are reserved for HDFC Employees and 2,99,82,781 shares are reserved for HDFC Shareholders. Out of net 26,68,95,517, 35% shares are reserved for Retail Investors.

Object of the issue:

The company will not receive any proceeds from the offer as it is 100% Offer For Sale. The objects of the offer are to achieve the benefits of listing the Equity Shares on the stock exchanges and to carry out the sale of Offered Shares by the Promoter Selling Shareholders. Since the initial public offering of HDFC Bank in the year 1995, this is the first initial public offering by a company promoted by HDFC and listing of Equity Shares will enhance the "HDFC Life" brand name and provide liquidity to the existing shareholders. The listing will also provide a public market for Equity shares in India

Price, EPS and PE Ratio

This IPO is a big avoid IPO as it is highly priced. Recently, four iconic insurance companies IPOs have come and gone viz. ICICI Lombard, SBI Life, General Insurance and New India Assurance, all of them trapped the investors by taking advantage of bull market sentiments. All of them were overpriced which miserably led to either undersubscription or no listing gain for investors. They were not worth subscribing. HDFC Life is no exception. HDFC Life is trying to encash the brand name of HDFC. However, it is not necessary that big name will bring benefits.

Well, the company has set price range between Rs.275 - Rs.290 per share. The EPS (Dilluted on consolidated basis) as on March 31,2017 was Rs. 4.42 per share. At higher and lower price band, PE Ratio is arrived at 62.22 - 65.61. Having seen the fiascos of SBI Life, investor should stay away from such expensive share.

The Industry highest PE Ratio is 69.64 (SBI Life) and Lowest 33.4 (ICICI Prudential). From this angel, ICICI Prudential is much cheaper share. If you are interested to have shares in insurance sector, then it is better to buy ICICI Prudential rather to waste time and hard earned money in HDFC Life.

Average cost of acquisition by existing shareholders viz HDFC is merely Rs. 10.71 and Standard Life Mauritius is Rs. 41.79

Book value to price ratio

The net asset value per Equity share as on March 31,2017 was Rs. 19.1. At higher and lower price band, book value to price ratio comes to 14.40 - 15.18. From this angel also, HDFC Life share is quite expensive. This is nothing but the greed of promoters.

Return on Net Worth:

Return on net worth gone down from 35.20% in Fiscal 2015 to 25.60% in Fiscal 2017.

Peer Comparison:

ICICI Prudential share is the best and cheapest share in Life Insurance sector.

Litigations:

There are approx. 106 litigations pending against the company, covering exposure of Rs. 5184.03 Crore. More pending litigation shows administrative inefficiencies of the management.

Conclusions:

This IPO should be avoided.

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer : I write review based on my knowledge and experience. Investors should do their own research before applying)

Well, the company has set price range between Rs.275 - Rs.290 per share. The EPS (Dilluted on consolidated basis) as on March 31,2017 was Rs. 4.42 per share. At higher and lower price band, PE Ratio is arrived at 62.22 - 65.61. Having seen the fiascos of SBI Life, investor should stay away from such expensive share.

The Industry highest PE Ratio is 69.64 (SBI Life) and Lowest 33.4 (ICICI Prudential). From this angel, ICICI Prudential is much cheaper share. If you are interested to have shares in insurance sector, then it is better to buy ICICI Prudential rather to waste time and hard earned money in HDFC Life.

Average cost of acquisition by existing shareholders viz HDFC is merely Rs. 10.71 and Standard Life Mauritius is Rs. 41.79

Book value to price ratio

The net asset value per Equity share as on March 31,2017 was Rs. 19.1. At higher and lower price band, book value to price ratio comes to 14.40 - 15.18. From this angel also, HDFC Life share is quite expensive. This is nothing but the greed of promoters.

Return on Net Worth:

Return on net worth gone down from 35.20% in Fiscal 2015 to 25.60% in Fiscal 2017.

ICICI Prudential share is the best and cheapest share in Life Insurance sector.

Litigations:

There are approx. 106 litigations pending against the company, covering exposure of Rs. 5184.03 Crore. More pending litigation shows administrative inefficiencies of the management.

Conclusions:

This IPO should be avoided.

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer : I write review based on my knowledge and experience. Investors should do their own research before applying)

Your article is very informative. Thank you for sharing such information with us. Visit our site once more for more information related to stocks.

ReplyDeleteEureka Forbes

Saudi Aramco IPO

CSB IPO

Arohan IPO