Astron Paper & Board Limited - Should you subscribe?

After MAS Financial and Shalby Limited, yet another Gujarat based company is going to hit the primary market. Ahmedabad based company having manufacturing plant in Halvad, Gujarat is going to raise between 63 - 70 Crore through IPO. The issue is very small compared previous two companies. Astron IPO is opening on December 15,2017 and closing on December 20,2017. The tentative dates of allotment and listing are December 29,2017 and December 31,2017. Allotment status can be checked on this link http://www.linkintime.co.in

Incorporated in 2010, and promoted by Kirit J Patel, Ramakant Patel, Karshanbhai Patel and Asian Granito (India) Limited, Astron is engaged in manufacturing of kraft paper. Kraft paper is used by packaging industry for manufacturing corrugated boxes and liners, corrugated sacks and composite containers. Its varied products include High RCT, Kraft Liner, Liner to corrugated medium paper, ranging mainly from 140 GSM to 350 GSM and 22-35 BSF.

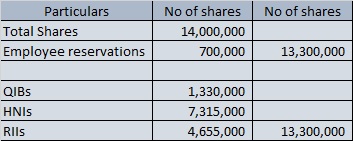

The company is issuing 1,40,00,000 shares. 7,00,000 is kept reserved for employees. Out of 1,32,00,000 shares, 35% is reserved for retail investors.

Object of the issue : This IPO is 100% Fresh Issue. After deducting issue related expenses, proceeds received through IPO shall be utilized for the following objects;

1. Setting up of additional facility for manufacturing of Kraft Paper with lower GSM ranging from 80 to 180 GSM and lower B. F ranging from 12 B F to 20 B F

2. Part repayment of unsecured loan availed by the company

3. Funding the working capital requirement of the company

4. General corporate purposes.

The objective of IPO is attractive as approx 32% of proceeds shall be utilized for additional facility which will add few more products in its portfolio which ultimately generate more revenue in future. However, it will take a couple of years to reap the benefits.

Should you subscribe this IPO? I've written important points to be taken into account.

From Fiscal 2014 to Fiscal 2017, its total revenue has shown growth from Rs 106.20 Crore to Rs. 184.59 Crore representing CAGR of 14.82%. Its EBITDA has shown growth from Rs 11.32 Crore to Rs. 23.01 Crore representing CAGR of 17.95%, its PAT has shown growth from loss of Rs. 3.02 Crore to a profit of Rs. 9.96 Crore and its RoNW has shown growth from -12.78 to 21.98%. Its revenue, EBITDA and PAT for the six month ended September 30,2017 was Rs. 110.96 Crore, Rs. 14.62 Crore and Rs.9.46 Crore respectively, with an EBITDA margin of 13.18% and PAT margin of 8.52%.

The company seems to be a performer. Presently, its entire sale is in India, however, the company is exploring export market. Here, it is noteworthy that the company has started making profit since three years. A few more things are worrisome. There certain emphasis of matters in auditor's report which can have materials effect on the financials. The same are given below:

1. Note relating to the non-provision for doubtful debts amounting to Rs. 0.59 Crore

2. Note relating to the disputed CENVAT of excise amounting to Rs. 0.26 Crore and appropriate interest as per Excise Law and penalty of Rs. 0.26 Crore

3. Note relating to the disputed income tax amount of Rs. 0.04 Crore for the A Y 2013-14

4. Note relating to the disputed income tax amount of Rs. 0.04 Crore for the A Y 2014-15

First two cases can have material impact on the financial statement of the company. All disputes are pending at different adjudication levels.

Apart from this, statutory auditors for 2017 and 2016 have reported that certain observations in their reports on Companies (Auditor's Report)Order, 2003 (to extend applicable) and Companies (Auditors Report) Order 2015. These matters include delay in payment of statutory dues, delay in repayment of loans, non - maintenance of Fixed Assets register etc.

Pricing of the share : The company has set price range between Rs. 45 - Rs.50 per share and EPS for Fiscal 2017 was Rs 3.06. At lower and upper price range, PE ranges between 14.71 - 16.34. From PE Multiple, pricing is reasonable. Six month ended September 30, 2017, the company registered Rs. 2.91 (not annualized) EPS. If we annualized and work out new PE, then the share becomes much cheaper.

Book value of share as on March 31,2017 was Rs. 13.94. The company has asked the price of 3.23 - 3.59 time of its book value. The NAV as on September 30,2017 was Rs. 16.62 which further brings down PB to 2.71 - 3.01. From PB Multiple also, share seems to be reasonable.

Comparison with peers : Shree Ajit Pulp and Paper, Genus Paper and Board, South Indian Paper Mill are the listed peers of Astron. As on December 15,2017, from PE Multiple angle, Astron share is cheaper than other three, while from PB angle, Astron share is little expensive. Astron's RoNW is 21.98% which is much higher than its peers. None of three has RoNW in double digits.

From the above table, it can be seen that Astron's share price is much reasonable and strong.

Competitive strengths : Experienced management and dedicated employee base, Scalable business model, Quality certifications, Repeat orders, Location advantages.

Business strategy : Setting up of additional manufacturing facility which will increase its product range, expands its demographic reach through marketing network, continue to improve operating efficiency through technology enhancements, forward integration.

Capacity utilization : As on March 31,2017, the installed capacity was for 80,000 MT PA which was utilized up to 63, 371 MT (i.e. 79.21%). As on date, the capacity is 96,000 MT PA. Further, the company is expanding manufacturing facility for further 30,000 MT.

Conclusion:

After seeing the poor listing of Shalby Limited which is fundamentally stronger than Astron, I am very much afraid of applying this IPO. It is much better to lose the listing opportunity than to lose the capital. The company has become profitable since three years only, let two more years to earn the profit. We can buy from the market after two years.

The company has auditor's qualifications, plus, emphasis of matter is very critical. The company is family run. And we have seen many family run companies have unorganized management which can hamper the wealth appreciation for shareholders. I would recommend to AVOID this IPO

Thank you for reading...Jai Hind

CA Prashant Seta

(Note : I write review based on my knowledge and understanding. The reader of this article should do his/her own research before applying)

From Fiscal 2014 to Fiscal 2017, its total revenue has shown growth from Rs 106.20 Crore to Rs. 184.59 Crore representing CAGR of 14.82%. Its EBITDA has shown growth from Rs 11.32 Crore to Rs. 23.01 Crore representing CAGR of 17.95%, its PAT has shown growth from loss of Rs. 3.02 Crore to a profit of Rs. 9.96 Crore and its RoNW has shown growth from -12.78 to 21.98%. Its revenue, EBITDA and PAT for the six month ended September 30,2017 was Rs. 110.96 Crore, Rs. 14.62 Crore and Rs.9.46 Crore respectively, with an EBITDA margin of 13.18% and PAT margin of 8.52%.

The company seems to be a performer. Presently, its entire sale is in India, however, the company is exploring export market. Here, it is noteworthy that the company has started making profit since three years. A few more things are worrisome. There certain emphasis of matters in auditor's report which can have materials effect on the financials. The same are given below:

1. Note relating to the non-provision for doubtful debts amounting to Rs. 0.59 Crore

2. Note relating to the disputed CENVAT of excise amounting to Rs. 0.26 Crore and appropriate interest as per Excise Law and penalty of Rs. 0.26 Crore

3. Note relating to the disputed income tax amount of Rs. 0.04 Crore for the A Y 2013-14

4. Note relating to the disputed income tax amount of Rs. 0.04 Crore for the A Y 2014-15

First two cases can have material impact on the financial statement of the company. All disputes are pending at different adjudication levels.

Apart from this, statutory auditors for 2017 and 2016 have reported that certain observations in their reports on Companies (Auditor's Report)Order, 2003 (to extend applicable) and Companies (Auditors Report) Order 2015. These matters include delay in payment of statutory dues, delay in repayment of loans, non - maintenance of Fixed Assets register etc.

Pricing of the share : The company has set price range between Rs. 45 - Rs.50 per share and EPS for Fiscal 2017 was Rs 3.06. At lower and upper price range, PE ranges between 14.71 - 16.34. From PE Multiple, pricing is reasonable. Six month ended September 30, 2017, the company registered Rs. 2.91 (not annualized) EPS. If we annualized and work out new PE, then the share becomes much cheaper.

Book value of share as on March 31,2017 was Rs. 13.94. The company has asked the price of 3.23 - 3.59 time of its book value. The NAV as on September 30,2017 was Rs. 16.62 which further brings down PB to 2.71 - 3.01. From PB Multiple also, share seems to be reasonable.

Comparison with peers : Shree Ajit Pulp and Paper, Genus Paper and Board, South Indian Paper Mill are the listed peers of Astron. As on December 15,2017, from PE Multiple angle, Astron share is cheaper than other three, while from PB angle, Astron share is little expensive. Astron's RoNW is 21.98% which is much higher than its peers. None of three has RoNW in double digits.

From the above table, it can be seen that Astron's share price is much reasonable and strong.

Competitive strengths : Experienced management and dedicated employee base, Scalable business model, Quality certifications, Repeat orders, Location advantages.

Business strategy : Setting up of additional manufacturing facility which will increase its product range, expands its demographic reach through marketing network, continue to improve operating efficiency through technology enhancements, forward integration.

Capacity utilization : As on March 31,2017, the installed capacity was for 80,000 MT PA which was utilized up to 63, 371 MT (i.e. 79.21%). As on date, the capacity is 96,000 MT PA. Further, the company is expanding manufacturing facility for further 30,000 MT.

Conclusion:

After seeing the poor listing of Shalby Limited which is fundamentally stronger than Astron, I am very much afraid of applying this IPO. It is much better to lose the listing opportunity than to lose the capital. The company has become profitable since three years only, let two more years to earn the profit. We can buy from the market after two years.

The company has auditor's qualifications, plus, emphasis of matter is very critical. The company is family run. And we have seen many family run companies have unorganized management which can hamper the wealth appreciation for shareholders. I would recommend to AVOID this IPO

Thank you for reading...Jai Hind

CA Prashant Seta

(Note : I write review based on my knowledge and understanding. The reader of this article should do his/her own research before applying)

Comments

Post a Comment