Varroc Engineering Ltd IPO - Should you subcribe?

June' 2018 has witnessed that IPO market has been picking up its momentum. In April'2018, there was not a single mainstream IPO. In May'2018, IndoStar Capital Finance inaugurated Fiscal 2019 IPO market. The company got good response but failed to give sound listing gain. It listed with meagre premium and went down to below its issue price. Presently, the share is trading at 4% discount to its issue price.

In June 2018, Government PSU RITES Ltd and oleochemical based additives manufacturer Fine Organic Industries Ltd came up with their IPOs. They too have succeeded to get good response in the market. They have registered good subscription figures. However, results are yet to be seen. The listing day will establish the real success or failure for the investors. There may not be much listing gain but both shares are fundamentally strong and wealth creators in long term.

Now, yet another IPO is going to hit the primary market in the last week of June'18. Incorporated in May 1988, Aurangabad, Maharashtra headquartered company Varroc Engineering Ltd is opening on June 26, 2018. This is 18th mainstream IPO of 2018 and 3rd IPO of June, 2018. There is a similarity in all the three IPOs of June 2018, all the IPOs are 100% Offer For Sale. There is no fresh equity issue. In October 2016, its peer Endurance Technologies had entered the market and given humongous return to its investors. Rs. 472 share is currently trading at Rs. 1302.9, 173% premium to its issue price.

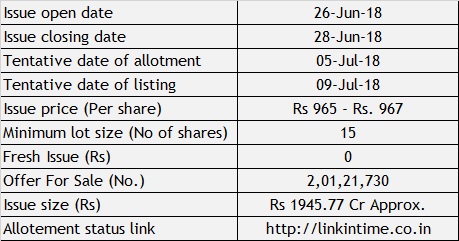

Varroc Engineering - Issue Details

Varroc Engineering - Overview

The company is a global tier-1 (tier-1 companies are companies that directly supply to original equipment manufacturers ("OEMs")) automotive component group. It designs, manufactures and supplies exterior lighting systems, plastic and polymer components, electrical-electronics components, and precision metallic components to passenger car, commercial vehicle, two-wheeler, three-wheeler and off highway vehicle ("OHV") OEMs directly worldwide.

The company commenced operations with its polymer business in 1990. The company initially grew organically in India by adding new business lines, such as its electrical division and metallic division. Subsequently, the company diversified its product offerings and expanded its production capacity through various investments, joint ventures and acquisitions. The company has end-to-end capabilities across design, R&D, engineering, testing, manufacturing and supply of various products across its business.

The company has a global footprint of 36 manufacturing facilities spread across seven countries, with six facilities for its Global Lighting Business, 25 for its India Business and five for its Other Businesses.

Within its India Business, the company has 25 manufacturing facilities and five R&D centers spread across India. Its Indian manufacturing and distribution footprint is strategically located across key Indian automotive hubs, allowing it to be close to its customers and helping to ensure cost efficiency. The company has a long-standing relationship with Bajaj Auto Ltd ("Bajaj"), a leading two-wheeler manufacturer, which has been its customer for the past 28 years and to whom the company has been providing components across its product lines. Its other key two -wheeler customers in India include Honda, Royal Enfield, Yamaha, Suzuki and Hero. It also exports to global two-wheeler manufacturers from its facilities in India, namely KTM and Volvo.

Pricing of the share:

The company has asked the price which is 29 PE Multiple of Fiscal 2018 earning and 4.61 times of its NAV as on March 31, 2018. The price seems very reasonable as its industry highest PE is 46.43, lowest PE is 37.13 and average PE is 40.63. Its peers are trading at highest 8.35 PB.

Peer Comparison:

Its peers are Motherson Sumi, Bharat Forge and Endurance Technologies. The peer comparison is given below:

Objects of the offer:

As it is 100% Offer For Sale by the promoter, promoter group and investing shareholders, the company shall not receive any proceeds from the issue. The objects of the Offer are to achieve the benefits of listing the Equity Shares on the Stock Exchanges and to carry out the Offer for Sale by Selling Shareholders. Further, the Company expects that listing of the Equity Shares will enhance its visibility and brand image and provide liquidity to its Shareholders. The list of selling shareholders is given below:

Financials of the company:

The company's revenue for Fiscal 2016, 2017 and 2018 was Rs. 8218.90 Crore, Rs. 9608.54 Crore and Rs. 10378.46 Crore, respectively, and its earnings before interest, taxes, depreciation and amortization ("EBITDA") before exceptional items was Rs. 591.57 Crore, Rs. 675.48 Crore and Rs. 916.18 Crore, respectively. From FY2016 to FY2018 it had a compound annual growth rate ("CAGR") of 12.37% in terms of revenue. It has 4% PAT over its total revenue.

For FY2018, its return on average equity ("RoE") was 18.0% and its annualised return on capital employed ("RoCE") was 16.9%.

Conclusion:

This company is a cash rich company. It has mere 0.31 debt/equity ratio as on March 31,2018. The company has been paying dividend consistently. In Fiscal 2018, the company has declared 50% dividend.

The company's competitive strengths are; Strong competitive position in attractive growing market, Strong, long standing relationship with customers, Comprehensive product portfolio, Low cost, strategically located manufacturing and design footprint, Robust in-house technology, innovation and R & D Capabilities, Consistent track record of growth and operational and financial efficiency

The industry in which it operates has huge potential for growth. One should subscribe this IPO.

Thank you for reading...Jai Hind

(Note: I write review based on my knowledge and understanding. The reader of this blog should do his/her own research before applying)

Comments

Post a Comment