RITES Ltd IPO - Should you subscribe?

As per Modi Government's disinvestment plan to garner Rs. 72,500 in Fiscal 2018, in March 2018, three cash rich profit making defense PSUs had hit the primary market with 100% Offer for sale IPOs viz. Bharat Dynamics Ltd, Hindustan Aeronautics Ltd and Mishra Dhatu Nigam Ltd. In spite of having strong fundaments and robust growth opportunities ahead, all the three IPOs got lame response from the investors. The low response was partly due to LTCG applicability from April 1, 2018 and partly due to bearish sentiments in the equity market. On listing day, Bharat Dynamics and Hindustan Aeronautics heavily disappointed their subscribers. The sheer bearishness could be witnessed on that day. BDL listed at a little premium while HAL failed to even touch its issue price. Presently, BDL and HAL are trading at 7% and 22% discount to their issue prices respectively. However, Mishra Dhatu proved to be a shining star giving outstanding return to its subscribers. Presently, Mishra Dhatu is trading at 52.78% premium to its issue price. It made people wonder how things turned out in PSU IPOs.

RITES Ltd - Brief Profile

Incorporated in April, 1974, RITES Ltd is a wholly owned government company. It is a Miniratna (Category – I) Schedule ‘A’ Public Sector Enterprise and a leading player in the transport consultancy and engineering sector in India and the only company having diversified services and geographical reach in this field under one roof.

RITES Ltd is incorporated by the Ministry of Railways, Government of India (“MoR”) and has the benefit of being associated with the Indian Railways, which is the fourth longest rail network in the world. Since its inception in 1974, it has evolved from its origins of providing transport infrastructure consultancy and quality assurance services and has developed expertise in:

1. Design, engineering and consultancy services in transport infrastructure sector with focus on railways, urban transport, roads and highways, ports, inland waterways, airports and ropeways;

RITES Ltd is incorporated by the Ministry of Railways, Government of India (“MoR”) and has the benefit of being associated with the Indian Railways, which is the fourth longest rail network in the world. Since its inception in 1974, it has evolved from its origins of providing transport infrastructure consultancy and quality assurance services and has developed expertise in:

1. Design, engineering and consultancy services in transport infrastructure sector with focus on railways, urban transport, roads and highways, ports, inland waterways, airports and ropeways;

2. Leasing, export, maintenance and rehabilitation of locomotives and rolling stock;

3. Undertaking turnkey projects on engineering, procurement and construction basis for railway line, track doubling, 3rd line, railway electrification, up gradation works for railway transport systems and workshops, railway stations, and construction of institutional/ residential/ commercial buildings, both with or without equity participation; and Wagon manufacturing, renewable energy generation and power procurement for Indian Railways through its collaborations by way of joint venture arrangements, subsidiaries or consortium arrangements.

The company has significant presence as a transport infrastructure consultancy organization in the railway sector. However, it also provides consultancy services across other infrastructure and energy market sectors including urban transport, roads and highways, ports, inland waterways, airports, institutional buildings, ropeways, power procurement and renewable energy. It has , over the years, served various public sector undertakings, government agencies and instrumentalities and large private sector corporations, both in India and abroad.

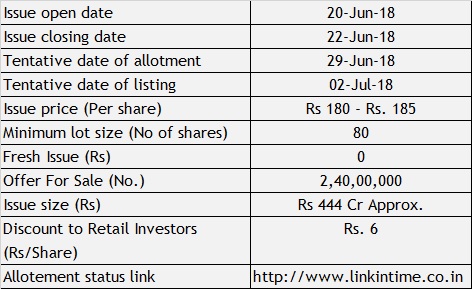

RITES Ltd - Issue details

RITES Ltd IPO is 100% offer for sale. The issue is opening along side yet another OFS IPO Fine Organic Industries Ltd

The company has significant presence as a transport infrastructure consultancy organization in the railway sector. However, it also provides consultancy services across other infrastructure and energy market sectors including urban transport, roads and highways, ports, inland waterways, airports, institutional buildings, ropeways, power procurement and renewable energy. It has , over the years, served various public sector undertakings, government agencies and instrumentalities and large private sector corporations, both in India and abroad.

RITES Ltd - Issue details

RITES Ltd IPO is 100% offer for sale. The issue is opening along side yet another OFS IPO Fine Organic Industries Ltd

RITES Ltd - Shares reservation category

Out of 24,000,000, 84,00,000 shares are reserved for Retail Individual Investors.

Out of 24,000,000, 84,00,000 shares are reserved for Retail Individual Investors.

RITES Ltd - Pricing

The company has set the price range between Rs. 180 - Rs. 185 per share (Rs. 6 discount for Retail investors). The EPS (Diluted on consolidated basis) as on March 31, 2017 was Rs. 17.63. At lower and upper price band, the PE ranges between 10.21 - 10.49. The pricing seems quite reasonable.

The company has set the price range between Rs. 180 - Rs. 185 per share (Rs. 6 discount for Retail investors). The EPS (Diluted on consolidated basis) as on March 31, 2017 was Rs. 17.63. At lower and upper price band, the PE ranges between 10.21 - 10.49. The pricing seems quite reasonable.

The NAV (on consolidated basis) as on December 31, 2017 was Rs. 108.6. The company has asked the price which is mere 1.66 - 1.70 times of its NAV. From this front also, the pricing seems quite reasonable.

There are no comparable listed companies in India engaged in the same line of business, hence, comparison with industry peers are not applicable. However, keeping mind the strong financial statistics of the company, the pricing seems quite reasonable.

We have noticed that the pricing of PSUs shares are kept very reasonable to attract the investors. However, previous IPOs badly failed to bring big investors on board.

Having seen the recent past, QIBs and FIIs have not been showing much interest in PSU stocks. Even in secondary market also, there is no huge demand for PSU stocks. Many bluechip companies shares are trading at much reasonable prices, so big investors would prefer to put their money in them rather than choosing PSU stocks.

Those who have burnt fingers in BDL and HAL fry pan may skip such risky IPO. However, I must say they those who have trusted BDL and HAL will definitely get good returns over a period of time. Hold on those shares as they are fundamentally very strong and will turn eventful.

RITES Ltd - Objects of the offer

RITES Ltd is 100% offer for sale. The President of India acting through MoR (Ministry of Railway) is offloading his part of shares. It is purely an arrangement to give a start to Modi government's disinvestment plan of Fiscal 2019. You will see many PSU IPOs this year ahead. Already Bharat 22 ETF is going to open from June 19, 2018. It is also a part of disinvestment plan of Fiscal 2019.

The objects of the Offer are (i) to carry out the disinvestment of 24,000,000 Equity Shares held by the Selling Shareholder in the Company, equivalent to 12% of the issued, subscribed and paid up Equity Share capital of the Company as part of the Net Offer, and 1,200,000 Equity Shares that will be reserved for Employee Reservation Portion, and (ii) to achieve the benefits of listing the Equity Shares on the Stock Exchanges. Further, the Company expects that listing of the Equity Shares will enhance its visibility and brand image and provide liquidity to its shareholders. Listing will also provide a public market for the Equity Shares in India. The Company will not receive any proceeds from the Offer and all the proceeds will go to the Selling Shareholder.

RITES Ltd - Financial Performances

The company has witnessed a consistent track record of strong financial performance and growth. Its total income has grown at a CAGR of 9.61% from Rs.1083.05 Crore in the Financial Year 2013 to Rs.1563.27 Crore in the Financial Year 2017 and its profit after tax has grown at a CAGR of 11.61% from Rs.233.06 Crore in the Financial Year 2013 to Rs. 361.66 Crore in the Financial Year 2017.

RITES Ltd - Financial Performances

The company has witnessed a consistent track record of strong financial performance and growth. Its total income has grown at a CAGR of 9.61% from Rs.1083.05 Crore in the Financial Year 2013 to Rs.1563.27 Crore in the Financial Year 2017 and its profit after tax has grown at a CAGR of 11.61% from Rs.233.06 Crore in the Financial Year 2013 to Rs. 361.66 Crore in the Financial Year 2017.

As on December 31, 2017, the net worth of the Company was Rs. 2171.994 Crore. Its earnings per share has increased from Rs 11.65 in the Financial Year 2013 to Rs 17.63 in the Financial Year 2017.

On standalone basis, it has an order book of Rs. 4818.68 Crore as on March 31, 2018 which includes 353 ongoing projects of value over Rs 1 Crore each.

The company has not given financials as on March 31, 2018

RITES Ltd - Debt free dividend paying company

RITES Ltd is a cash rich company. The company's debt/equity ratio as on December 31, 2017 was mere 0.032. Except one of its subsidiary REMCL, the group has not taken any loan. The outstanding balance as on March 31, 2018 was 534.88 Crore of REMCL. The financials as on March 31, 2018 was not given in RHP.

Like other government PSUs, this company has also been paying dividend consistently. In Fiscal 2017, the company declared 73% dividend.

RITES Ltd - Competitive strengths

Comprehensive range of consultancy services and a diversified sector portfolio in the transport infrastructure space

Large order book with strong and diversified clientele base across sectors

Technical expertise and business divisions with specialized domain knowledge

Experienced management personnel and technically qualified team

Strong and consistent financial performance supported by robust internal control and risk management system

Preferred consultancy organization of the Government of India including the Indian Railways

Conclusion

There may be mixed reactions to this IPO. It may go as Bharat Dynamics or Hindustan Aeronautics or can be another Mishra Dhatu. Moreover, the success of this IPO will depend on the participation of QIBs and other big investors. If only LIC participates as QIB, then it can not be said as QIB participation because LIC bails out PSU IPOs.

This IPO is for long term investors. It may not give listing gain. NEUTRAL

Thank you for reading...Jai Hind

(Note: I write reviews based on my knowledge and understanding. The reader of this blog should do his/her own research before applying)

Conclusion

There may be mixed reactions to this IPO. It may go as Bharat Dynamics or Hindustan Aeronautics or can be another Mishra Dhatu. Moreover, the success of this IPO will depend on the participation of QIBs and other big investors. If only LIC participates as QIB, then it can not be said as QIB participation because LIC bails out PSU IPOs.

This IPO is for long term investors. It may not give listing gain. NEUTRAL

Thank you for reading...Jai Hind

(Note: I write reviews based on my knowledge and understanding. The reader of this blog should do his/her own research before applying)

Comments

Post a Comment