Xelpmoc Design and Tech Limited IPO - Should you subscribe?

Incorporated in September 2015, Xelpmoc Design and Tech Limited has launched its IPO in this month after a break of almost four months in IPO Bazaar. This is the first mainline IPO of 2019.

The last IPO was launched by Dinesh Engineering Ltd in September 2018 which miserably failed to attract the investors, and finally had to be withdrawn due to undersubscription. Since then, no company has dared to launch its IPO in this uncertain and highly volatile market. However, Xelpmoc Design has come up with its plan to garner money through IPO.

The issue size is very small. The company is planning to garner meagre 23 Crore approx. through 100% Fresh Issue of shares.

Issue Details: The issue is opening on January 23, 2019 and closing on January 25, 2019. The tentative dates of allotment and listing are February 1, 2019 and February 4, 2019 respectively. The company has set the price range between Rs. 62 - Rs, 66 per share. Rs. 3 per share discount is offered to Retail Investors. The minimum lot size is for 200 shares.

Overview: Headquartered at Bengaluru, the IT hub of India, Xelpmoc Design and Tech Limited is a professional and technical consulting services provider, offering technology services and end-to-end technology solutions and support. The company's clients range from entrepreneurs and start-up enterprises to established companies, engaged in e-commerce, transportation and logistics, recruitment, financial services, social networking, and various other industries. The company provides a wide range of services, including, mobile and web application development, prototype development, thematic product development and data science and analytics assistance. It grows its portfolio of services and products as the needs of its clients evolve.

It commenced its operations in Bengaluru, India, in 2015 and has since serviced enterprises across four states in India. Its business operations may broadly be categorized as technology services, and technology solutions/ products. It also occasionally provides business support to some of its clients to enable them to set-up their operations. It believes it is among the few technology service providers with accessibility to domain experts. It benefits from the expertise and experience of its Promoters and senior management in a range of sectors including financial services, retail, media and entertainment, and business services. It also carries out its operations through its joint venture and associate.

Object of the issue: The company proposes to utilize the net proceeds towards funding the following objects:

1. Purchase of IT hardware and network equipment for development centers in Kolkata and Hyderabad;

2. Purchase of fit outs for new development centers in Kolkata and Hyderabad;

3. Funding working capital requirement of the company; and

4. General Corporate Purposes.

Revenues and Profitability:

Presently, the company is making losses. It seems quite pre-mature for the company to come up with its IPO at this stage and during such bearish sentiments. The company has hardly completed two full financial years. The company is established in September 2015 only. The investors are always apprehensive to invest in a loss making company as there are plenty of options available in the secondary market to invest in.

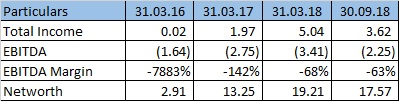

In Fiscal 2016, 2017 and 2018 and in the six months ended September 30, 2018, its total income was Rs. 0.02 Crore, Rs.1.97 Crore, Rs. 5.04 Crore and Rs. 3.62 Crore respectively. In addition, its EBITDA was Rs. (1.64) Crore, Rs. (2.75) Crore, Rs. (3.41) Crore and Rs. (2.25) Crore in Fiscal 2016, 2017 and 2018 and in the six months ended September 30, 2018, with EBITDA margins of (7,883.12%), (142.38%), (68.48%) and (62.76)%, respectively.

Pricing of the issue: At upper and lower price band (Rs. 62 - Rs. 66), the price is 3.60 - 3.83 times of its NAV as on September 30, 2018. As I am very conservative, I feel this share seems little costly to me. As it has negative EPS, another share price evaluation tool becomes useless i.e. PE Ratio.

Peer Comparison: Peer comparison is not possible as there are no listed peers in India which are engaged in the similar line of business or whose business is comparable with that of company's business.

Dividend and Debt-Equity Ratio: As the company has no profit so fat, it has not declared any dividend so far. You can not expect in near future either. The company's debt-equity ratio is nil, that means as of now the company has no debts.

Dividend and Debt-Equity Ratio: As the company has no profit so fat, it has not declared any dividend so far. You can not expect in near future either. The company's debt-equity ratio is nil, that means as of now the company has no debts.

Conclusion: The company has limited operating and financial history which makes it difficult to accurately assess its future growth prospects. Further, there is no details about order book of the company in the Red Herring Prospectus.

However, prima facie, it seems that the company has a potential to grow. In spite of having cut-throat competition in this industry, the company has been performing well. It's revenue and EBIDTA statistics are impressive.

The industry in which the company operates is highly competitive. The advancement in the technology is a challenge for this industry and this company is no exception. The company has dependency on limited clients. Yet, I am NEUTRAL for this IPO. One can see the anchor investor quality, first two days subscription statistics and then can decided to skip or apply.

Thank you for reading...Jai Hind

(I write reviews based on my knowledge and understanding. The reader of this blog should do his/her own research before applying)

I liked the way you explained the subject. Really, your blog has a lot of stuff. Thank you for sharing such valuable information with us. We also provide such information to Audience. You can also check our blog at once for more information.

ReplyDeleteRailTel IPO

S&P BSE IPO Index

Indian IPO market

IRCTC share price