Metropolis Healthcare Ltd IPO - Should you subscribe?

Converted from partnership firm into company in July 2003, Metropolis Healthcare Limited is a brand in healthcare sector. After MSTC Listing failed, Rail Vikas Nigam Ltd has not received good response on the third day of opening, and even by the time this article is being written. Metropolis Healthcare Ltd IPO is the sixth mainline IPO of the year 2019. This is yet another 100% offer for share.

Overview :

The company

offers a broad range of approximately 3,487 clinical laboratory tests and 530

profiles, as of December 31, 2018. The profile comprises of a variety of test

combinations which are specific to a disease or disorder as well as wellness

profiles that are used for health and fitness screening. It classifies its

tests into (i) ‘routine’ tests such as blood chemistry analyses, blood cell

counts and urine examination; (ii) ‘semi-specialized’ tests such as thyroid

function tests, viral and bacterial cultures, histology, cytology and

infectious disease tests; and (iii) ‘specialized’ tests such as tests for

coagulation studies, autoimmunity tests, cytogenetics and molecular

diagnostics. It is focused on providing reliable test results as well as

value-added services such as home collection of specimens and online access to

test reports. It also offers customized wellness packages to its institutional

customers as per their requirement. Its patient centric approach is a critical

differentiator which results in several individuals and healthcare providers

choosing it as their diagnostic healthcare service provider.

The company

conducts its operations through its laboratory and service network. It has

implemented a ‘hub and spoke’ model for quick and efficient delivery of

services through its widespread laboratory and service network, which covers

197 cities in India, as of December 31, 2018. As of December 31, 2018, its

laboratory network consists of 115 clinical laboratories, comprising (i) a

global reference laboratory (“GRL”) located in Mumbai, which is its main

‘hub’ and equipped to conduct majority of the tests offered by it; (ii) 14

regional reference laboratories (“RRLs”) (out of which four are located

outside India), which are equipped to conduct routine, semi-specialized and few

specialized tests; (iii) 56 satellite laboratories (out of which one is located

outside India), which are equipped to conduct routine and semi-specialized

tests; and (iv) 44 express laboratories (out of which five are located outside

India), which are equipped to conduct routine tests.

The

company’s service network caters to individual patients as well as

institutional customers. It services individual patients through 1,631 patient

touch points (out of which 26 are located outside India), as of December 31,

2018, including 256 patient service centers owned by it (“Owned PSCs”)

and 1,375 third party patient service centers (“Third Party PSCs”). It

services its institutional customers through approximately 9,552 institutional

touch points, as of December 31, 2018, including (i) approximately 9,000

pick-up points; and (ii) 552 assisted referral centers (“ARCs”) (out of

which seven are located outside India), which are its exclusive third party

referral centers.

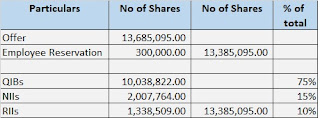

Issue Details : The issue is opening on April 3, 2019 and closing on April 5, 2019. The tentative dates of allotments and listing are April 12, 2019 and April 16, 2019. You can check the allotment status on https://linkintime.co.in. The offer for sale is for 1,36,85,095 shares of Rs. 2 FV. Out of that, 3,00,000 shares are reserved for employees.

Object of the issue: As it is 100% offer for sale arrangement, the company shall not receive any proceeds from the issue. The only objective is to get benefit of listing on the recognized stock exchanges. Promoter Dr Sushil Kanubhai Shah and investor shareholder CA Lotus Investment shall sell 62,72, 335 and 74,12,760 shares respectively under this arrangement.

Pricing of the issue: The company has set the price range between Rs. 877 to Rs. 880 per share. Minimum lot size is 17 shares. The basic EPS on consolidated basis as on March 31, 2018 was Rs. 20.61. At upper and lower price band, the PE Ratio ranges between 42.55 - 42.70. The industry highest, lowest and average PE is 50.57.

The price set is 9.40 times to 9.44 times of its NAV as on December 31, 2018.

Peer Comparison: Dr Lal Pathlabs Limited is the only peer of Metropolis. As on April 1, 2019, Dr Lal Pathlabs share was trading at 50.36 PE and at 10.83 times of its book value. At this front, Metropolis offer price seems to be reasonable.

On the other hand, RoNW (Return on Networth) of Metropolis was 24.66%, a little higher than Dr Pathlabs i.e. 21.61%.

Profitability:From financial year 2016 to financial year 2018, (i) its

revenue from operations grew from Rs. 4,75.47 Crore to Rs. 6,43.57 Crore,

representing a CAGR of 16.3%; (ii) its Adjusted EBITDA grew from Rs. 129.80

Crore to Rs.177.38 Crore, representing a CAGR of 16.9%; and (iii) its profit

for the year grew from Rs. 81.96 Crore to Rs.109.75 Crore, representing a CAGR

of 15.7%. During the nine-months period ended December 31, 2018, its revenue

from operations, Adjusted EBITDA and profit for the period were Rs. 5,59.31

Crore, Rs. 145.74 Crore and Rs.88.77 Crore, respectively. Adjusted EBITDA is a

supplemental measure of performance and is not prepared under or required by

Ind-AS.

Dividend: The company has paid dividend in three out of five years in the last five years.

Debt-Equity Ratio: The company is cash rich company. Debt-Equity ratio as on December 31, 2018 was mere 0.001.

Conclusion: Prima-facie, the IPO seems attractive. The only issue is long term promoters are exiting. On the other hand, the profitability, debt-equity ratio, peer comparison, dividend are all favorable. It may not give attractive listing gain. So, I would recommend to APPLY for medium to long term

(Note : I write review based on my knowledge and understanding. The reader of this article should do his/her own research before applying)

Good insights..

ReplyDeleteSince the long term promoters are leaving the company, will it impact the future profitability? As the long term strategy which were already laid down by promoters may undergo change.

ReplyDeleteGood research work

ReplyDeleteGood insights...

ReplyDelete“Benjamin Briel Lee was very professional at all times, keeping me aware of everything that was happening, If I had any questions he was always available to answer. This was my first home purchase, I didn’t know much about the loan process, he made it very easy to understand the things I had questions about. I really enjoyed working with him.”

ReplyDeleteHe's a loan officer working with a group of investor's who are willing to fund any project or loan you any amount with a very low interest.Contact Benjamin Briel Lee E-Mail: 247officedept@gmail.com Whats-App Number: +1-989-394-3740.