IndiaMart InterMESH Limited IPO - Should you subscribe?

Incorporated in September 1999, a Delhi based company IndiaMART InterMesh Ltd is going to debut in the capital market through its IPO. This is the first IPO launch after General Elections results declared on May 23, 2019. It seems that IPO market may pick up its momentum from this juncture. The Modi Government's victory will help to enhance confidence of investors and the companies, and accordingly bullish the IPO market.

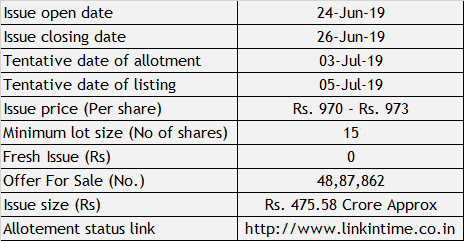

Issue Details: The issue is going to open on June 24, 2019 and closing on June 26, 2019. The tentative dates of allotment and listing are July 3, 2019 and July 5, 2019 respectively.

Out of 48,87,862 shares, 10,000 shares are reserved for employees. Out of balance 48,77,862 shares, 15% are reserved for Retail Investors.

Object of the issue: As it is 100% offer for sale, the company is not going to receive any proceeds out of this IPO arrangement. The objects are to achieve the benefit of listing the Equity Shares on the Stock Exchanges and for the sale of an aggregate of up to 48,87,862 shares by selling shareholders. The selling shareholders include both the investor shareholders and promoter shareholders. Further, none of the selling shareholders are exiting fully.

Overview: The company is India’s largest online B2B marketplace for business products and services with approximately 60% market share of the online B2B classifieds space in India in fiscal 2017, according to the KPMG Report. It primarily operates through its product and supplier discovery marketplace, www.indiamart.com or “IndiaMART”. Its online marketplace provides a platform for mostly business buyers, to discover products and services and contact the suppliers of such business products and services. IndiaMART had an aggregate of 325.8 million, 552.6 million and 723.5 million visits in fiscals 2017, 2018 and 2019, respectively, of which 204.8 million, 396.9 million and 550.3 million comprised mobile traffic, or 63%, 72% and 76% of total traffic, respectively.

IndiaMART provides a robust two-way discovery marketplace connecting buyers and suppliers. Buyers locate suppliers on its marketplace, including both Indian small and medium enterprises, or “SMEs”, and large corporates, by viewing a webpage containing the supplier’s product and service listings, or a “supplier storefront”, or by posting requests for quotes called “RFQs” or “BuyLeads”. Its marketplace offerings from which buyers can search for and view product and service listings cover a widespread range of industries spread across India, rather than relying on a single target industry or type of geography. As of March 31, 2019, it had organized its listings across 54 industries.

Pricing of the issue: The company has set the price range between Rs. 970 to Rs. 973 per share. Minimum lot size is for 15 shares. The EPS (Diluted on consolidated basis) as on March 31, 2019 was Rs.7.61. At upper and lower price range, the PE ranges between 127.46 to 127.86. The share seems very expensive. From the book value front, the selling shareholders have asked the price which is 17.34 - 17.40 times of its book value i.e. 55.92. The share is costly. As on date, the company doesn't have any listed peer in India, so the comparison can not be made.

Revenue and Profitability: The company has started earning profit since last two years only. Till March 31, 2017, the company registered losses.

Dividend: The company doesn't have declared any dividend since last five years.

Debt - Equity ratio: The company has no debt as on March 31, 2019. That means the company is run by its own money.

Conclusion: Though the company is good with 60% market share in its industry, it has very experienced management. However, I would AVOID this IPO. The company has started making profit just now and two years not enough to give the fair picture of company's profitability. Further, the pricing seems quite high.

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer: I write reviews based on my knowledge and understanding. The reader of this article should do his/her own research before taking any investment decision)

If you're looking to burn fat then you certainly need to start using this brand new personalized keto meal plan.

ReplyDeleteTo create this service, licenced nutritionists, fitness couches, and professional chefs have united to provide keto meal plans that are useful, suitable, money-efficient, and delicious.

From their launch in January 2019, 1000's of people have already completely transformed their figure and well-being with the benefits a smart keto meal plan can offer.

Speaking of benefits: clicking this link, you'll discover 8 scientifically-tested ones offered by the keto meal plan.

Nice informatiom. Thanks for sharing. You may also check latest updates on Stocks like

ReplyDeletePM Modi stimulus package

economic stimulus package

Sterlite Technologies

Havells Q4 results

I liked the way you explained the subject. Really, your blog has a lot of stuff. Thank you for sharing such valuable information with us. We also provide such information to Audience. You can also check our blog at once for more information.

ReplyDeleteRailTel IPO

S&P BSE IPO Index

Indian IPO market

IRCTC share price