Galaxy Surfactants Limited IPO - Should you subscribe?

Incorporated in May 1986, Galaxy Surfactants Limited is all set to hit the primary market. This is the 4th mainstream IPO of 2018. Previous IPOs namely Apollo Micro System listed with 70% premium registering sign of bull sentiments of IPO market. Those who were allotted the share must have danced in joy on listing day. Other two IPOs Newgen Software and Amber Enterprises results are yet to be declared. Having seen the subscription performance, the sentiments suggest that both shares will listed at reasonable premium.

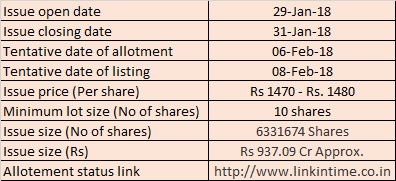

Galaxy Surfactants Limited Issue details:

The company shall not receive any proceeds as it is 100% Offer For Sale arrangement. The object of the offer is to achieve the benefits of listing the Equity Shares on the stock exchanges and the sale of Equity Shares by selling shareholders. Further, the company expects that listing of Equity Shares will enhance its visibility and brand image and provide liquidity to its existing shareholders.

6331674 shares are put for sale by 307 selling shareholders.

Revenue from operations and PAT:

The company's financials figures are very impressive. Its PAT has been improving year over year. From Fiscal 2014 to Fiscal 2017, its PAT (on consolidated basis) increased from Rs. 76 Crore to Rs. 146.31 Crore, representing a CAGR of 24.40%. For Fiscal 2017 and the six months period ended September 30,2017, its Total Revenues (on consolidated basis) were Rs. 2171. 7 Crore and Rs. 1197.27 Crore respectively.

Pricing of shares:

Revenue from operations and PAT:

The company's financials figures are very impressive. Its PAT has been improving year over year. From Fiscal 2014 to Fiscal 2017, its PAT (on consolidated basis) increased from Rs. 76 Crore to Rs. 146.31 Crore, representing a CAGR of 24.40%. For Fiscal 2017 and the six months period ended September 30,2017, its Total Revenues (on consolidated basis) were Rs. 2171. 7 Crore and Rs. 1197.27 Crore respectively.

Pricing of shares:

The EPS

for the Fiscal 2017 is Rs. 41.27. At upper and lower price band (Rs. 1470 - Rs.

1480), PE ranges between 35.62 - 35.86. The company has no

listed peer, so comparison is not possible. However, prima facie,

price set seems to be very reasonable. (We have seen IPO which were 100% Offer For Sale arrangement set the price at or above 50 PE, yet they listed with outstanding premium). GSL's EPS has grown phenomenally from Rs. 0.08 in

Fiscal 2013 to Rs. 41.27 in Fiscal 2017. RoNW for Fiscal 2017 is 28.68%

which is quite impressive. This is a sign of effective management

decision making at the right time in acquisition, amalgamation, joint venture and association.

NAV as on September 30,2017 is Rs. 179.11 per share. The selling shareholders have asked the price which is 8.21 - 8.27 times of NAV. Having seen the track record of the company, from this point also, price is pretty reasonable.

NAV as on September 30,2017 is Rs. 179.11 per share. The selling shareholders have asked the price which is 8.21 - 8.27 times of NAV. Having seen the track record of the company, from this point also, price is pretty reasonable.

Business line:

GSL is one of India's leading manufacturers of surfactants and other specialty ingredients for the personal care and home care industries. Its products find application in a host of consumer - centric personal care and home care products, including, inter alia, skin care, oral care, hair care, cosmetics, toiletries and detergent products. Since its incorporation in 1986, it has significantly expanded and diversified its product profile, client base and geographical footprint. Its customers include some of the leading multinational, regional and local players in the home and personal care industries. Currently its product portfolio comprises 200 product grades, which are marketed to more than 1700 customers in over 70 countries.

Customer base:

GSL's diversified customer base currently comprises multinational, regional and local FMCG companies, including, inter alia, Cavinkar Private Limited, Colgate - Palmolive (India) Limited, Dabur India Limited, Henkel, Himalaya, L'OREAL, Procter & Gamble Home Products Pvt Ltd, Reckitt Benckiser and Unilever.

Manufacturing facilities & subsidiary companies:

At present, GSL has 7 strategically - located manufacturing facilities, out of which 5 are located in India and 2 are located overseas. It has also set up 1 pilot plant at Tarapur, Maharashtra, for the scaling up of new products and processes from lab-scale to plant - scale.

At present, the company has five foreign subsidiaries. The foreign operations have phenomenally increased over the period of time.

It does its foreign business with help of its subsidiaries.

Dividend declaration:

GSL has been declaring dividend consistently. So far GSL has remained very liberal in giving reward to its shareholders. However, post IPO, the same liberal approach cannot be expected.

Debt - Equity ratio:

The debt - equity ratio shows the effectiveness of utilization of funds. Higher the debts, higher the finance cost leading to hit on PAT. Higher debt may also indicates unplanned utilization of resources, funds blockage in current assets etc

In case of GSL, the debt - equity ratio has been improving year over the years. As on September 30, 2017, Debt/Equity ratio was 0.58:1, and further Long term debt/Equity ratio was 0.25:1. The same was too high back in Fiscal 2013. The company has been reducing its debt which shows the sign of good fundamentals. GSL is a cash rich company.

Competitive strengths:

Established Global Supplier to Major FMCG Brands with Demonstrated Track Record: In Fiscal 2017, 52%, 8% and 40% of its total revenues from operations were derived from multinational customers, regional customers and local customers respectively

Robust product portfolio addressing Diverse Customers Needs: Its performance surfactants range includes anionic surfactants and non-ionic surfactants, and comprises over 45 product grades. Its specialty care products range comprises over 155 product grades.

Proven R & D Capabilities with Dedicated focus on Innovation: The company has well equipped R & D Center at Navi Mumbai. It has also set up 1 pilot plant at Tarapur, Maharashtra, which enables trial runs of the new production processes and products prior to commencement of commercial production. It has also set up a product applications center for proteins at Denville, USA which is operated by Tri - K Industries (The company's subsidiary's subsidiary). In Fiscal 2015, 2016, 2017, GSL spent RS. 10.28 Crore, Rs. 12.10 Crore and Rs. 13.19 Crore respectively on R & D activities.

Global foot print supporting local reach: On acquisition of Tri - K Industries in USA in Fiscal 2010, significantly enhanced its product portfolio of Specialty Care Products and its technological capabilities whilst also extending its reach in the developed market of USA.

Strong presence in high growth markets of India and AMET (Africa Middle East Turkey) Region: The market for personal care products in India was USD 11.36 Billion in Fiscal 2015, and is expected to grow at a CAGR of 7.9%, to touch USD 22.52 Billion by 2024. Further, the market for home care products in India was USD 2.31 Billion in Fiscal 2015, and is expected to grow at a CAGR of 7.2%, to touch USD 4.32 Billion by 2024. The aggregate market for personal care and home care products in Africa and the Middle East was USD 22.04 Billion in Fiscal 2015, and is expected to grow at a CAGR of 4.43%, to touch USD 31.19 Billion by 2024.

Professional and experienced management team: Company's promoters, namely Mr. Unnathan Shekhar, Mr. Gopalkrishnan Ramakrishnan, Mr. Shashikant Shanbhag and Mr. Sudhir Dattaram Patil, have been associated with the Company since its incorporation in 1986, and have played a significant role in the development of our business. They have an average experience of over 35 years, out of which an average of over 30 years have been with the company. Moreover, its senior management consists of experienced and qualified professionals with experience across various sectors.

Track record of robust financial performance: Over the years, the company has strategically invested significantly in capacity expansion and de-bottle necking at its manufacturing facilities as well as in its R&D endeavors. Its ability to make these investments helps strengthen trust and engagement with its customers, which enhances its ability to retain these customers and extend its engagement across products and geographies.

Conclusion:

APPLY. Though it is a 100% Offer For Sale, it is worth applying.

Thank you for reading....Jai Hind

CA Prashant Seta

(Note : I write reviews based on my knowledge and understanding. The readers of this article should do their own research before applying)

Follow us on:

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Established Global Supplier to Major FMCG Brands with Demonstrated Track Record: In Fiscal 2017, 52%, 8% and 40% of its total revenues from operations were derived from multinational customers, regional customers and local customers respectively

Robust product portfolio addressing Diverse Customers Needs: Its performance surfactants range includes anionic surfactants and non-ionic surfactants, and comprises over 45 product grades. Its specialty care products range comprises over 155 product grades.

Proven R & D Capabilities with Dedicated focus on Innovation: The company has well equipped R & D Center at Navi Mumbai. It has also set up 1 pilot plant at Tarapur, Maharashtra, which enables trial runs of the new production processes and products prior to commencement of commercial production. It has also set up a product applications center for proteins at Denville, USA which is operated by Tri - K Industries (The company's subsidiary's subsidiary). In Fiscal 2015, 2016, 2017, GSL spent RS. 10.28 Crore, Rs. 12.10 Crore and Rs. 13.19 Crore respectively on R & D activities.

Global foot print supporting local reach: On acquisition of Tri - K Industries in USA in Fiscal 2010, significantly enhanced its product portfolio of Specialty Care Products and its technological capabilities whilst also extending its reach in the developed market of USA.

Strong presence in high growth markets of India and AMET (Africa Middle East Turkey) Region: The market for personal care products in India was USD 11.36 Billion in Fiscal 2015, and is expected to grow at a CAGR of 7.9%, to touch USD 22.52 Billion by 2024. Further, the market for home care products in India was USD 2.31 Billion in Fiscal 2015, and is expected to grow at a CAGR of 7.2%, to touch USD 4.32 Billion by 2024. The aggregate market for personal care and home care products in Africa and the Middle East was USD 22.04 Billion in Fiscal 2015, and is expected to grow at a CAGR of 4.43%, to touch USD 31.19 Billion by 2024.

Professional and experienced management team: Company's promoters, namely Mr. Unnathan Shekhar, Mr. Gopalkrishnan Ramakrishnan, Mr. Shashikant Shanbhag and Mr. Sudhir Dattaram Patil, have been associated with the Company since its incorporation in 1986, and have played a significant role in the development of our business. They have an average experience of over 35 years, out of which an average of over 30 years have been with the company. Moreover, its senior management consists of experienced and qualified professionals with experience across various sectors.

Track record of robust financial performance: Over the years, the company has strategically invested significantly in capacity expansion and de-bottle necking at its manufacturing facilities as well as in its R&D endeavors. Its ability to make these investments helps strengthen trust and engagement with its customers, which enhances its ability to retain these customers and extend its engagement across products and geographies.

Conclusion:

APPLY. Though it is a 100% Offer For Sale, it is worth applying.

Thank you for reading....Jai Hind

CA Prashant Seta

(Note : I write reviews based on my knowledge and understanding. The readers of this article should do their own research before applying)

Follow us on:

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Comments

Post a Comment