Newgen Software Technologies Ltd IPO - Should you subscribe?

Newgen Software Technologies Ltd is going to make its debut in the equity market on January 16,2018. The issue is closing on January 18,2018. The tentative dates of allotment and listing are January 26, 2018 and January 28, 2018 respectively. Allotment status can be checked on this link http://karisma.karvy.com. The company has set price range between Rs. 240 - Rs.245 and minimum application lot is 61 shares.

Newgen is a software products company offering a platform that enables organization to rapidly develop powerful applications addressing their strategic business needs. The applications created on the company’s platform enables the organizations to drive digital transformation and competitive differentiation.

Its customers use its platform to rapidly design, build and implement enterprise grade custom applications through its intuitive, visual interface with minimal coding. Its platform comprises of:

Enterprise Content Management (ECM): Its OmniDocs Enterprise Content Management Software allows digitization of enterprise content and information. Its platform provides smart tools for enterprises to capture and extract information from various sources, classify, store, archive or retrieve as well as dispose-off any content and documents required in day-to-day business operations. It provides the flexibility to access or deliver content over mobile and cloud creating a highly connected and digital workplace. It offers a robust US DoD 5015.02 – STD Certified Records Management Systems to ensure compliance with regulatory requirements in relation to management of records.

Business Process Management (BPM): Its OmniFlow Intelligent Business Process Suite (OmniFlow iBPS) is an integrated system which allows enterprises to manage a complete range of business processes, including designing and modelling flow of work, executing the flow of work through the workflow engine and monitoring the flow of work for future improvement. OmniFlo iBPS also offers dynamic case management capabilities which allow decision-makers to respond to real time opportunities, challenges and other unanticipated situations while maintaining a high level of collaboration.

Customer Communication Management (CCM): Its OmniOMS Customer Communication Management suite offers a unified communication platform that allows enterprises to improve communication with their customers by delivering a personalized, targeted and consistent communication through various channels.

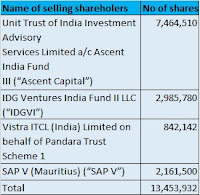

Newgen Software IPO is a mix of fresh issue and offer for sale arrangement. The company shall issue fresh shares up to Rs. 95 Crores. The selling shareholders have put 1,34,53, 932 shares in Offer for sale arrangement which is their full exit from the company.

Post issue - Ascent India Fund and IDGVI will hold 60 shares each.

Post issue - Ascent India Fund and IDGVI will hold 60 shares each.

When there is full exit by the selling shareholders, it becomes very difficult to judge the IPO at first. The good thing is that only investor shareholders are exiting, either promoter or promoter group shareholders have not participated in Offer For Sale. However, other possibility can not be ruled out. When there is full exit by investor shareholders, it can be assumed that they are not seeing any further growth or potential in the company.

The IT industry faces severe competition and are subject to rapid technological changes and Newgen Software is no exception. It should not be forgotten that the global economy has witnessed town turn in IT industry.

Its business has multiple revenue streams including from:

1. Sale of software products: Onetime upfront license fees in relation to the platform deployed on premise

2. Annuity based revenue: Recurring fees charges from the following

A. Saas (Software as a Service) : Subscription fees for licenses in relation to platform deployed on cloud

B. ATS/AMC: charges for annual technical support and maintenance (including updates) of licenses, and installation

C. Support: charges for support and development services

3. Sale of services: milestone based charges for implementation and development, and charges for scanning services

The company shall not receive any proceeds from the Offer for sale by the selling shareholders. The net proceeds up to Rs. 84.33 Crore of the Fresh Issue shall be utilized for purchase and furnishing of office premises near Noida - Greater Noida expressway, Uttar Pradesh and balance for General Corporate purposes. Further, the company expects that the listing of the Equity Shares will enhance its visibility and brand image among its existing and potential customers.

At upper and lower price band, PE Multiple comes to 22.79 - 23.27. The selling shareholders have asked the price which is 5.65 times of its NAV. The company has no any listed peer. So, comparison is not possible. However, there are other Tech Companies which are trading at cheaper PE. They are much bigger and having better growth potential. Newgen share is expensive.

Revenue from operations and PAT figures are very fluctuating and scaring. PAT in Fiscal 2015 slipped from Rs. 46. 38 Crore to Rs. 27.82 Crore in Fiscal 2016 and again jumped to Rs. 52.36 Crore in Fiscal 2017. The reason was mainly due to huge expenditure on R & D in Fiscal 2016.

% of profit over its revenue from operations is on decreasing trend though revenue from operations have increased. PAT % has gone down from 18.37% in Fiscal 2013 to 12.26% in Fiscal 2017. This is human driven industry. The company has to hire skilled manpower to grow which in turn increases its employees costs. The company has not managed pace with employee cost to profitability. The companies are forced to reduce the profit margin due to cut - throat competition and increased manpower costs.

There is phenomenal fluctuations in Other Income as well. This is mainly due to sale of profit on sale of Mutual Fund Units . Profit on sale of mutual fund should be plainly ignored while calculating PAT (PAT generated from Revenue from operations). The PAT comes down to Rs 45.69 Crore in Fiscal 2017 which reduces PAT %.

The company has five subsidiaries: 1) Newgen Computers Technologies Limited, India 2) Newgen Software Inc, USA, 3) Newgen Software Technologies Canada Ltd, 4) Newgen Software Technologies (UK) Ltd, UK, 5) Newgen Software Technologies Pte Ltd, Singapore. The interesting thing is combined revenue from operations of all five subsidiaries is merely 11% of Softgen Software Technologies Limited and contribution in consolidated PAT is merely Rs. 2.21 Crore. There is peanut revenues from subsidiary companies. In fact, as such Indian subsidiary is not doing any business.

The IT industry faces severe competition and are subject to rapid technological changes and Newgen Software is no exception. It should not be forgotten that the global economy has witnessed town turn in IT industry.

Its business has multiple revenue streams including from:

1. Sale of software products: Onetime upfront license fees in relation to the platform deployed on premise

2. Annuity based revenue: Recurring fees charges from the following

A. Saas (Software as a Service) : Subscription fees for licenses in relation to platform deployed on cloud

B. ATS/AMC: charges for annual technical support and maintenance (including updates) of licenses, and installation

C. Support: charges for support and development services

3. Sale of services: milestone based charges for implementation and development, and charges for scanning services

The company shall not receive any proceeds from the Offer for sale by the selling shareholders. The net proceeds up to Rs. 84.33 Crore of the Fresh Issue shall be utilized for purchase and furnishing of office premises near Noida - Greater Noida expressway, Uttar Pradesh and balance for General Corporate purposes. Further, the company expects that the listing of the Equity Shares will enhance its visibility and brand image among its existing and potential customers.

At upper and lower price band, PE Multiple comes to 22.79 - 23.27. The selling shareholders have asked the price which is 5.65 times of its NAV. The company has no any listed peer. So, comparison is not possible. However, there are other Tech Companies which are trading at cheaper PE. They are much bigger and having better growth potential. Newgen share is expensive.

Revenue from operations and PAT figures are very fluctuating and scaring. PAT in Fiscal 2015 slipped from Rs. 46. 38 Crore to Rs. 27.82 Crore in Fiscal 2016 and again jumped to Rs. 52.36 Crore in Fiscal 2017. The reason was mainly due to huge expenditure on R & D in Fiscal 2016.

% of profit over its revenue from operations is on decreasing trend though revenue from operations have increased. PAT % has gone down from 18.37% in Fiscal 2013 to 12.26% in Fiscal 2017. This is human driven industry. The company has to hire skilled manpower to grow which in turn increases its employees costs. The company has not managed pace with employee cost to profitability. The companies are forced to reduce the profit margin due to cut - throat competition and increased manpower costs.

There is phenomenal fluctuations in Other Income as well. This is mainly due to sale of profit on sale of Mutual Fund Units . Profit on sale of mutual fund should be plainly ignored while calculating PAT (PAT generated from Revenue from operations). The PAT comes down to Rs 45.69 Crore in Fiscal 2017 which reduces PAT %.

The company has five subsidiaries: 1) Newgen Computers Technologies Limited, India 2) Newgen Software Inc, USA, 3) Newgen Software Technologies Canada Ltd, 4) Newgen Software Technologies (UK) Ltd, UK, 5) Newgen Software Technologies Pte Ltd, Singapore. The interesting thing is combined revenue from operations of all five subsidiaries is merely 11% of Softgen Software Technologies Limited and contribution in consolidated PAT is merely Rs. 2.21 Crore. There is peanut revenues from subsidiary companies. In fact, as such Indian subsidiary is not doing any business.

One more interesting thing is company's revenue from operations consists of 19.42% revenue from subsidiary companies. (Rs. In Cr)

Conclusion:

AVOID. I am not finding anything interesting to apply this IPO. There are other options available in the market. However, based on first two days subscription response, on can take the decision to apply or not.

Thank you for reading...Jai Hind

CA Prashant Seta

(Note : I write reviews based on my knowledge and understanding. Readers of this article should do their own research before applying)

Follow us on

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Comments

Post a Comment