Aster DM Healthcare Limited IPO - Should you subscribe?

Aster DM is the fifth mainstream IPO of 2018, and first after Union Budget 2018. The year 2017 remained very successful year for the primary market. However, in Budget 2018, FM Arun Jaitley's move to reintroduce LTCG on sale of shares and mutual funds may not go well to maintain the existing trend. 10% LTCG already wiped out 5.00 L Crores of investors wealth in a matter of two days, and will further continue to impact in decision making of investing in the market. Though, the market has been gaining the momentum and recovering from the trauma, yet losses cannot be paid off soon.

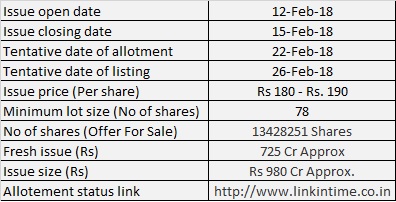

Aster DM issue details are given below:

As evident from above, it is a mix of Fresh issue and offer for sale. The company shall not receive any proceed from offer for sale. The company proposes to utilize net proceeds from the Fresh Issue towards the following objects

1. Repayment and/or prepayment of debt;

2. Purchase of medical equipment

3. General corporate purposes

2. Purchase of medical equipment

3. General corporate purposes

Overview of the company:

Incorporated in January 2008 by its founder Dr Azad Moopen and co-promoted by Union Investments Private Limited, Aster DM is one of the largest private healthcare service providers which operate in multiple GCC states (Gulf Cooperation Council) based on numbers of hospitals and clinics, according to the Frost & Sullivan Report, and an emerging healthcare player in India. It currently operates in all of the GCC states, which comprise the United Arab Emirates, Oman, Saudi Arabia, Qatar, Kuwait and Bahrain, in Jordan (which it classifies as a GCC state as part of our GCC operations), in India and the Philippines. Its GCC operations are headquartered in Dubai, United Arab Emirates and Indian operations are headquartered in Kochi, Kerala.

The operates in multiple segments of the healthcare industry, including hospitals, clinics and retail pharmacies and provide healthcare services to patients across economic segments in several GCC states through its various brands “Aster”, “Medcare” and “Access”.

The company had 149 operating facilities, including 10 hospitals with a total of 1,419 installed beds, as of March 31, 2013 and have expanded to 323 operating facilities, including 19 hospitals with a total of 4,754 installed beds, as of September 30, 2017. Further, it entered into an operation and management services agreement with Rashtreeya Sikshana Samithi Trust in Bengaluru effective February 25, 2017 to provide operation and management services at a hospital in J P Nagar, Bengaluru. In August 2014, it launched Aster Medcity in Kochi, Kerala, a multi-specialty hospital with a 670 bed capacity, to be positioned as a destination for medical value travel. In the GCC states, the number of its clinics increased from 41 as of March 31, 2013 to 90 as of September 30, 2017, and the number of retail pharmacies increased from 98 as of March 31, 2013 to 206 as of September 30, 2017.

Should you subscribe? No.

The company has set price range between Rs. 180 - Rs. 190 per share. The EPS (diluted on consolidated basis) for the Fiscal 2017 was Rs. 4.28. At upper and lower price band, PE Multiple ranges between 42.05 - 44.39. The company registered negative EPS in Fiscal 2016 (Rs. -1.35) and again as on September 30,2017 (Rs. -1.65). In Fiscal 2017, the company had a loss, but due to some addition of exceptional item in P & L A/c, the company is showing positive Profit and EPS. Overall, the scale at which company is working, the result is not reflecting in its financial statements. At this level of operations, the company should be cash rich, instead the company running out of cash.

The company experienced negative cash flows from operations in the recent past, including Rs. 42.41 Crore, Rs. 71.30 Crore, Rs. 4.18 Crore and Rs. 50.67 Crore for Fiscals 2014, 2015, 2016 and 2017 respectively. They were primarily on account of losses incurred during these years on standalone basis and increase in receivables during these periods.

The company has incurred net losses (i.e. total comprehensive income attributable to owners of the company excluding non-controlling interest) amounting to Rs.15.28 Crore on consolidated basis in Fiscal 2016 and Rs. 169.22 Crore during Fiscal 2016 and Rs. 77.96 Crore in Fiscal 2015 on standalone basis.

The company's NAV as on March 31,2017 was Rs.40.50 which slipped to Rs.39.13 as on September 30,2017. Besides, RoNW for Fiscal 2016 was in negative (-14.06%) and again in September 30,2017 (- 4.22%)

Overall, healthcare sector shares are overpriced in the market. In comparison with its peers, Aster DM share price seems reasonable, yet there is no certainty of profit and positive cash flows.

The company's occupancy rates in the GCC stood at 64.97%, 63.27%, 60.10% and 50.87% for fiscal 2015, 2016 and 2017 and for the six months ended September 30, 2017, respectively, and its occupancy rates in India stood at 62.09%, 64.07%, 60.45% and 67.92% for fiscal 2015, 2016 and 2017 and for the six months ended September 30, 2017, respectively. It also had significant capital expenditures of Rs. 4,16.73 Crore, Rs. 7,60.26 Crore, Rs. 9,31.95 Crore and Rs. 2,03.71 Crore for fiscal 2015, 2016 and 2017 and for the six months ended September 30, 2017 respectively.

Conclusion:

Stay away from this IPO. Avoid to invest in a company (well established company) which has negative EPS.

Thank you for reading....Jai Hind

CA Prashant Seta

(Note: I write reviews based on my knowledge and understanding. The readers of this blog should do their own research before making any investment decision)

Follow us on:

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

(Note: I write reviews based on my knowledge and understanding. The readers of this blog should do their own research before making any investment decision)

Follow us on:

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Interesting analysis..keep it up prashant

ReplyDeleteNice post regarding health care gulf industry.After read this blog i have very good information for us.There are such a interesting article ...

ReplyDeleteThanks for sharing such a valuable information..

health care gulf industry

Wow what a Great Information about World Day its very nice informative post. thanks for the post. Healthcare Marketing Experts

ReplyDeleteI really appreciate the kind of topics you post here. Thanks for sharing us a great information that is actually helpful. Good day! Healthcare

ReplyDeleteI think this is a really good article. You make Persian Gulf Countries Health Care Gulf Industry information interesting and engaging. You give readers a lot to think about and I appreciate that kind of writing.

ReplyDeleteReally very useful tips are provided here.

ReplyDeleteradiology outsourcing to India | telerad services | teleradiology companies in india