H G Infra Engineeing Ltd IPO - Should you subscribe?

Converted from partnership firm M/s Hodal Singh Giriraj Singh & Co into the company in January 2003, Rajasthan based H G Infra Engineering Ltd is going to hit primary market in last week of February 2018. This is the sixth mainstream IPO of 2018.

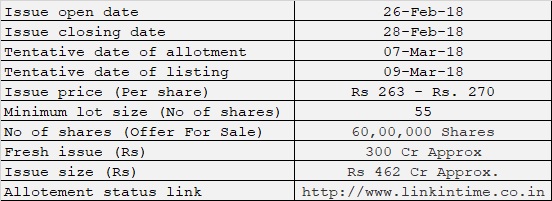

The issue details are as under:

The number of shares in offer for sale are 11.10% of its existing share capital.

H G Infra Engineering Ltd is an infrastructure construction, development and management company with extensive experience in its focus area of road projects, including highways, bridges and flyovers. Its main business operations include (i)providing engineering, procurement and construction (“EPC”) services on a fixed-sum turnkey basis and (ii) undertaking civil construction and related infrastructure projects on item rate and lump sum basis, primarily in the roads and highway sector. It has also forayed into executing water pipeline projects and is currently undertaking two water supply projects in Rajasthan on turnkey basis which includes the designing, construction, operation and maintenance of the project.

The company has executed or is executing projects across various states in India covering Rajasthan, Uttar Pradesh Haryana, Uttarakhand, Maharashtra and Arunachal Pradesh. During the last five years, the Company has completed 13 projects above the contract value of ₹ 40 Crore in the roads and highways sector aggregating to a total contract value of ₹ 16,74.89 Crore, which included construction, improving, widening, strengthening of two and four lane highways, construction of high level bridge and construction of earthen embankment, culverts and cart track underpasses.

Object of the offer

Offer for sale : The company will not receive any proceeds of the Offer For Sale by the Selling Shareholders.

Fresh issue: The net proceeds of fresh issue are proposed to be utilized by the company for the following purposes:

The General Corporate purpose strategic initiatives, funding growth opportunities, repayment/prepayment of short-term debts, strengthening marketing capabilities and brand building exercises, meeting on going general corporate exigencies and any other purpose as may be approved by the board subject to maximum 25% of net proceeds.

Pricing of the share:

The company has set price range between Rs. 263 - Rs. 270. The EPS for Fiscal 2017 is Rs. 9.87 (Basic and diluted on consolidated basis). At lower and higher price band, PE Ranges between 26.64 - 7.36.

Peer comparison : As on February 22,2018, the company's listed peer Dilip Buildcon is trading at 34.79 PE, KNR Construction is trading at 35.99, PNC Infratech Ltd at 35.45 and J Kumar Infra at 23.69. Sadbhav Engineering and Ashoka Buildcon registered negative EPS. As seen, H G Infra is cheaper than Dilip, KNR and PNC but costlier than J Kumar.

From PB (Price/Book value) angle, H G Infra is expensive. Its PB ranges between 8.08 - 8.29 (at Floor - bottom issue price) while Dilip is trading at 7.63, KNR at 4.71, PNC at 2.88, and J Kumar at 1.79. Loss making Sadbhav and Ashoka trading at 5.36 and 1.94 respectively. On the other hand, H G Infra's RoNW is 30.32% while Dilip has 20.81%, KNR 11.24%, PNC 8.09% and J Kumar 7.60%.

H G Infra's debt equity ratio is 1.72 as on March 31,2017 while its peer J Kumar Infra has merely 0.31 at the similar scale of operations. Debt Equity ratio determines company's debts over its shareholders fund (Share capital + Reserves and Surplus). Higher the debt equity ratio, it is assumed the company is running out of cash and too much dependent on borrowed fund (either short term or long term).

The summarized peer comparison

It is to be noted that H G Infra has not declared any dividend in the last five years

Company's profitability

H G Infra has witnessed a few ups and down in terms of revenue and PAT in the last five years. In the six months ended September 30, 2017 and Fiscal 2017, 2016, 2015 and 2014 its total revenue, as restated, on a consolidated basis were ₹ 5,69.53 Crore, ₹ 10,58.58 Crore, ₹ 7,43.29 Crore, ₹ 3,67.59 Crore and ₹ 4,72.95 Crore, respectively, and in Fiscal 2013 its total revenue, as restated, on a standalone basis was ₹ 3,25.44 Crore. In the six months ended September 30, 2017 and Fiscal 2017, 2016, 2015 and 2014 its profit after tax, as restated, on a consolidated basis was ₹ 29.28 Crore, ₹ 53.33 Crore, ₹ 35.35 Crore, ₹ 4.64 Crore and ₹ 10.90 Crore, respectively, and its profit after tax, as restated on a standalone basis was ₹ 15.14 Crore.

It has been able to increase its total revenue from Fiscal 2013 to Fiscal 2017 at a CAGR of 34.30 % and its profit after tax has increased at a CAGR of 37.00% over the same period.

In September 2017, SREI Infrastructure Finance Ltd promoted Bharat Road Network Ltd had hit the market. BRNL is in the similar line of business. The issue somehow managed to fully subscribe (1.81 times), but failed on box office (on stock exchange on listing day). Even today, BRNL share is trading at discount. Though H G Infra Engineering is in the similar line of business, the story is different. H G is a profit making company. As on November 30, 2017, the Company has 21 ongoing projects in the roads and highways sector which includes construction, improving, widening, strengthening, upgradation and rehabilitation of two, four and six lane highways construction of high level bridge and construction of road network. Its Order Book for these ongoing projects in the roads and highways sector amounted to ₹ 35,85.31 Crore as on November 30, 2017, accounting for 96.70% of its total Order Book. As of November 30, 2017, it had a total Order Book of ₹ 37,07.81 Crore, consisting of 21 projects in the roads and highways sector, four civil construction projects and two water supply projects.

Conclusion :

There are some positive points and negative points of H G Infra.

Positive points Order book is full, making reasonable profits(PAT 5% of its total revenue), experienced management team, impressive RoNW percentage.

Negative points : Higher debt-equity ratio, no dividend in last five years, too much dependency on government projects, little expensive than its peer J Kumar which has higher scale of business operation but trading at lower rate, inconsistent profitability in the last five years.

I am NEUTRAL on this IPO having seen the present bearish market sentiments. There seems distant reality of giving impressive listing gain. However, after anchor investors response on the issue and later two days subscription figures (QIBs and HNI) are seen, one should take the call on the last day.

Thank you for reading...Jai Hinf

CA Prashant Seta

(Note: I write reviews based on my knowledge and understanding. The reader of this article should do his/her own research before making any investment decision)

Follow us on :

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Follow us on :

Facebook : https://www.facebook.com/investmentbazaarr.blogspot/?ref=bookmarks

Comments

Post a Comment