Capacit'e Infraprojects Limited - Should you subscribe?

September 2017 should be celebrated as an IPO month. Back to back IPOs are lined up. Companies are desperate to pull the money from the market, and investors are desperate to find right place for their money to invest. The two very good IPOs waiting to the primary market viz. Capacit'e and ICICI Lombard. Here, we shall discuss about Capacit'e Infraprojects.

Overview of the company

Capacit'e Infraprojects is a fast growing construction company focussed on Residential, Commercial and Institutional building with exponential growth in consolidated revenue year over year and an order book of Rs. 4602. 476 Crore as at May 31,2017 comprising 56 ongoing projects.

It provides end-to-end construction services for residential buildings ("Residential"), multi level car parks, corporate office buildings and building for commercial purposes (Collectively, "Commercial") and buildings for educational, hospitality, and healthcare purposes ("Institutional"). Its capabilities include constructing concrete building structures as well as composite steel structure. It also provides mechanical, electrical and plumbing ("MEP") and finishing works.

It predominantly operates in Mumbai Metropolitan Region ("MMR"), the National Capital Region ("NCR") and Bengaluru. Its operations are geographically divided into MMR & Pune ("West Zone"), NCR and Patna ("North Zone"), and Bengaluru, Chennai, Hyderabad, Kochi and Vijaywada ("South Zone")

Capacit'e works for reputed clients and are associated with some marquee construction projects in India. Some of its clients include Kalptaru, Oberoi Constructions Limited, The Wadhwa Group, Saifee Burhani Upliftment Trust, Lodha Group, Rustomjee, Godrej Properties Limited, Brigade Enterprises Limited and Prestige Estate Projects Limited.

Issue Details:

Capacit'e Infraprojects IPO is opening on September 13,2017 and closing on September 15,2017. The company will raise Rs. 400 Crore through issue of fresh equity. The tentative date of listing is September 25,2017. Here, there is no offer for sale from existing share holders, 100% fresh issue. Before going ahead, I would like say that this IPO is worth subscribing after Apex Frozen Foods Ltd. I've analysed the Red Herring Prospectus in detail and listed my views on the same.

Object of the issue:

The objects of the issue are;

1. Funding working capital requirements;

2. Funding purchase of capital assets (System formwork); and

3. General corporate purposes

The net proceeds are proposed to be utilised towards the following;

The general corporate purposes includes but not limited to repayment of loans, strategic initiatives, partnership and joint ventures, acquiring fixed assets including furniture and fixtures, etc

Six main reasons : Why should you subscribe Capacit's Infraprojects Limited IPO?

Fairly priced shares:

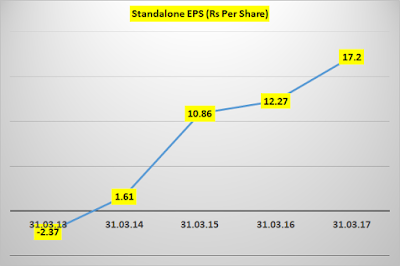

The company has set the price range between Rs 245 - 250 per share. EPS for the Fiscal 2017 is Rs. 17.20 per share on standalone basis. If we take lower and higher price band, PE Multiple comes between 14.24 to 14.53. Look at the growth of EPS year over year, it seems that share price set is very reasonable. I would say, it is under priced because Industry PE Ratio is 22.57 at the highest side and 20.19 at the lowest side. Return on net worth is also impressive.

Comparison with peers

The company has registered better performance in comparison with its peers. The company's all figures are fantastic

Strong financial performance

Comparison with peers

The company has registered better performance in comparison with its peers. The company's all figures are fantastic

Strong financial performance

Incorporated in 2012, the company has grown exponentially in last five years. Revenue from operations increased from meagre 2.61 Crore in 2013 to 1125.08 Crore in 2017. PAT was negative in 2013 which was closed at 69.31 Crore in 2017. Such growth is the sign of strong fundamentals of the company.

(Rs In Cr)

(Rs In Cr)

Order Plate is substantially full:

Since company's incorporation in August 2012, the company has undertaken projects across various segments in Residential, Commercial and Institutional buildings. As of May 31, 2017, the company has an order book aggregating to Rs 46,02. 48 Crore with projects spread across major regions in India, including the MMR, NCR, Pune, Hyderabad, Bengaluru, Chennai, Kochi and Vijaywada. Its order book as at May 31, 2017, is 3.98 times the consolidated revenue from operations for the financial year ended March 31, 2017 and consisted of orders for construction of 12 Super High Rise Buildings, 23 High Rise Buildings, 6 Other Buildings, 14 Gated Communities and one Villament. The company has very sound client base and receives repeat orders.

Expanding presence in other cities with high growth potential

The company has ongoing projects in MMR, NCR, Bengaluru, Chennai, Hyderabad and Pune all of which are regions with high growth potential. (Source: CRISIL Report). It intends to increase its presence in these locations by bidding for and securing new projects, including securing repeat orders from its existing clients. It intends to bid for, and execute, a greater percentage of projects, particularly in major cities in the South Zone where it has a presence, thereby also enhancing the geographic distribution of its projects, while reducing concentration in a few markets such as MMR. Additionally, it intends to expand its presence in other cities, such as Ahmedabad, which it believes may present high growth potential in the near future.

Benefit of "Housing for all by 2022" initiative

The company believes that with the announcement of recent government initiatives such as “Housing for All by 2022” by the Union Cabinet, which are aimed at redevelopment of existing structures with participation from private developers and promotion of affordable housing, there is significant potential for building construction services being required in the near future. For example, the Housing for All by 2022 initiative, also known as the Pradhan Mantri Awas Yojana, launched on June 25, 2015, envisages the construction of about 20 million houses in India from 2015 to 2022. (Source: CRISIL Report). The company intends to capitalise on the same by bidding for new construction projects, including in the redevelopment projects segment and the mass housing projects segment in major cities in India. It believes that its experience in execution of projects relating to redevelopment such as Saifee Burhani Upliftment Project – Sub cluster 03 and Rustomjee Seasons, as well as the projects in Gated Communities such as Kalpataru Immensa and Godrej Central will provide appropriate qualification credentials for undertaking redevelopment and mass housing projects.

Experienced and sound promoters, directors and management team

The company's promoters Mr Rohit R Katyal, Mr Rahul R Katyal and Mr Subir Malhotra have significant experience in

construction industry. Its board includes certain directors having more than 20

years experience in construction industry. The company has achieved a measure

of success in attracting an experienced senior management team with operational

and technical capabilities, management skills, business development experience

and financial management skills. The combined strength of promoters, directors

and senior management team provides access to marquee clients in securing new

orders and expanding its business. This has enabled it to strengthen its

presence. The expertise and experience of its promoters, directors

and senior management team coupled with client relationships gives it a

competitive edge in the building construction industry.

Clean management and reasonable salaries & wages drawn by Key Management Personnel

There is no single litigation pending against the company or its promoters, directors. The management is clean and seems to have efficient administration. Unlike we see in other companies where KMPs draw fat salaries, here Mr Rohit Katyal, Mr Rahul Katyal and Mr Sabir Malhotra draws reasonable salaries and wages if we see their level of experience. Rs. 0.88 Crore, Rs. 0.85 Crore, and Rs. 0.99 Crore respectively draw by them

Conclusion:

This seems to be very good IPO. SUBSCRIBE

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer : I have opined based on my knowledge and understanding. Investor should do his/her own research before applying)

simple and factual. Will apply. Thanks.

ReplyDeleteThank you...:)

Delete👍

ReplyDelete