Matrimony.com Limited IPO - Should you subscribe?

Matrimony.com limited is the first matchmaking and marriage service company in India going to be public. As far as online match making business is concern, its two main competitors are Shadi.com and Jeevansathi.com.

Matchmaking has traditionally been a very fragmented and unorganized industry in India, with friends and family being the predominant channel of matchmaking. Other offline channels of matchmaking include traditional matchmakers/brokers, community marriage bureaus, pundits/maulvis/priests and classifieds (prints).

The online matchmaking industry is still at a nascent stage and accounts for approximately 6.00% of marriages in India. The online matchmaking industry in India is also a very fragmented market with over 2,600 wedding portals, only a handful of players of which have some scale and 700 of which are an extension of the community bodies which traditionally played a major role in alliance and matchmaking

Matrimorny.com is currently comprises of two segments – (i) matchmaking services and (ii) marriage services and related sale of products. In fiscal 2017, matchmaking services and marriage services accounted for all of its revenue and there was no revenue from the related sale of products. Its matchmaking service segment is based on a subscription revenue model and its marriage services segment is based on a diverse revenue model ranging from listing fees, transaction fees and commission income.

While profile registration on its websites, mobile sites and mobile apps is free and it offers certain services to both free and paid members on its websites, mobile sites and mobile apps, the ability to access contact information of prospective matches and certain other features and functionalities (such as the ability to send personalized messages to, access verified mobile numbers of, view the social and professional profiles and horoscopes of, or have personalized chats with, other members) is only reserved for paid members. Subscription on its websites, mobile sites and mobile apps is pre-paid and packages are available for a term of three months to one year. In fiscal 2017 and the three months ended June 30, 2017, (i) subscription revenue accounted almost all of its revenue for matchmaking service and (ii) its matchmaking services segment accounted for 95.85% and 94.13% of its consolidated total revenue, respectively, and it had 702,000 and 190,000 paid subscriptions, respectively.

Out of 30,80,000 active profiles, only 7,02,000 were paid subscription, i.e 22.79%. First, subscriber creates free profile on the website, and it is not always necessary that he/she would turn into paid subscriber.

As the recent time has witnessed every IPO gets oversubscribed, companies are trying to tap the bull sentiments in the air. No matter what price range is set or what are the company's fundamentals, investors are crazy behind every IPO.

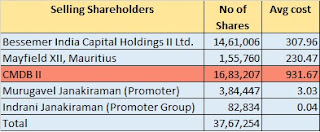

Like any other company, Matrimony.com limited has come up with its IPO consisting of fresh issue of Rs. 130 Crore worth shares and offer for sale of 37,67, 254 shares.

The bigwigs believes in right time entry and right time exit. The company had filed Draft Red Herring Prospectus (DRPH) on August 18,2015. The board at its meeting held on November 30,2016 decided to defer the launch of IPO due to market conditions. Subsequently, the Board in its meeting on April 21,2017 has decided to proceed with the IPO activity. Except CMDB II, the average of cost of acquisition of shares is very less.

The company has set price range of Rs 983 - Rs. 985 per share for the face value Rs 5 share. Retail investors are offered Rs. 98 discount per share, so it comes to Rs 885 - Rs. 887. Again, the price band is too high seeing the financials of the company. The company has started earning profit just now. Its NAV (Net Asset Value) per share is still negative. Rs. -14.67 on consolidated basis. The company has negative net worth. In fact, in 3 out of 5 years, auditors qualified report stating the fact that the company's accumulated losses as at the end of the relevant financial years were more than 50% of its net worth. It could put company's 'going concern' in danger. Further, in Fiscal 2014, Matrimonry.com submitted petition to Honourable High Court of Judicature at Madras to set off of accumulated revenue loss of Rs. 92.54 Crore as on March 31,2013 against unutilised portion of securities premium account to enable the company to present a clean balance sheet by neutralizing and removing the accumulated book losses and to facilitate the declaration of dividends by the company to its shareholders. Next two years, company did not make any profit.

PE Multiple for Retails comes to around 43.48 and non - retailers comes to around 48.28 which seems to be difficult to justify.

There are two many litigations against the company, its promoters and its subsidiaries. While running the business, it is natural for every company to have litigations against or by company, but this company had landmark litigation against it, its subsidiary in US which took away company's 110 Crore. Litigations happens due to inefficient administration.

Object of the issue

After deducting the Offer related expenses, the objects for which the company intends to use the Net Proceeds are:

1. Advertising and business promotion activities;

2. Purchase of land for construction of office premises in Chennai;

3. Repayment of our overdraft facilities; and

4. General corporate purposes.

After deducting the Offer related expenses, the objects for which the company intends to use the Net Proceeds are:

1. Advertising and business promotion activities;

2. Purchase of land for construction of office premises in Chennai;

3. Repayment of our overdraft facilities; and

4. General corporate purposes.

The above objects are set to attract the investors. Half of the object amount, company could manage from its cash and equivalent in its balance sheet.

Incorporated in 2001, the company has not managed to buy its own office. Now company will buy office from public's money.

Except pricing of shares, there are a few positive points also such as:

1. The company has offered Rs. 87 discount per share to Retail Investors.

2. Online match making industry accounts only 6% marriages, so prima facie there is a big market to capture and the object of the issue can help to achieve it

3. 22.79% are paid subscribers, so exponential growth can be expected.

The above positive points are not ruling out its financials weakness and the track record.

Conclusion:

There is no much to write about this company. This is a risky IPO. I would not recommend to apply seeing the profit for one year only. There is negative net worth and NAV. EPS is also not so attractive.

We experienced SIS IPO, GTPL, and S Chand. All IPOs were oversubscribed in all categories, you can check CMP of all, they are in discount.

AVOID THIS IPO

Thank you for reading..Jai Hind

CA Prashant Seta

(Disclaimer: This is my personal opinion based on my knowledge and understanding. You should do your own research before investing)

We experienced SIS IPO, GTPL, and S Chand. All IPOs were oversubscribed in all categories, you can check CMP of all, they are in discount.

AVOID THIS IPO

Thank you for reading..Jai Hind

CA Prashant Seta

(Disclaimer: This is my personal opinion based on my knowledge and understanding. You should do your own research before investing)

👌👍

ReplyDelete