Prataap Snacks Limited IPO - Should you subscribe?

Every shining 'Yellow' thing is not gold. The same way 'Yellow Diamond' is not real diamond to prospective shareholders. Indore based regional player Prataap Snacks Ltd running Yellow Diamond brand name is going to hit the primary market. After Bharat Road Network Ltd and Matrimonry.com Ltd, fundamentally not so good company Prataap Snacks Ltd is also going to trap the market to take the advantage of current bull IPO bull market. Regardless of hard core fundamentals of the company, every IPO is getting oversubscribed. No matter what share price is set, does that justify the RoNW (Return On Networth) and EPS (Earning Per Share) of the company, IPOs are getting overwhelming response from every category of subscriber.

Prataap Snacks Ltd's IPO is opening on September 22,2017 and closing on September 26,2017. The tentative date of allotment is September 29,2017. You can see allotment status on this link http://karisma.karvy.com and the tentative date of listing is October 3,2017.

Issue details:

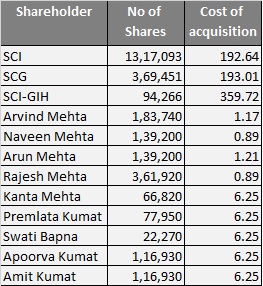

This issue is combination of both, fresh issue and offer for sale. The company will garner Rs. 200 Crore through fresh issue and existing 12 shareholder shall sell 30,05,770 shares. The company managed to get pre-IPO placement for Rs. 50 Crore. On August 25, 2017, Malabar India Fund Limited and Malabar Value Fund acquired 5,33,000 shares @ 938.09 per share.

The company has set price range between Rs 930 - Rs 938 for Rs. 5 face value share. If I take upper price, it is ranging from 2.61 times to 1053. 93 times of the cost of acquisition of promoters and investment company. The summary of cost of acquisition is given below:

Look at the cost of acquisitions, the promoter and promoter group shareholders have less than 1 Rupee cost per share.

Should you subscribe?

AVOID this IPO. The main reason is the valuation of share is too high for Rs. 5 face value share. The EPS and RoNW is not impressive to justify such high price. The EPS for fiscal 2017 was meagre Rs. 4.77. If we take higher and lower price range i.e. 930 - 938, PE Multiple comes to 194.97 - 196.65. Its listed peer Britannia Industries is trading at 56.62 PE Multiple. Prataap Snacks is too small to compare with giant Britannia Industries, so we can compare with other listed peer DFM Food which is trading 87.81 PE Multiple. It indicates that Britannia Industries and DFM Foods are much cheaper than Prataap Snacks. If I take the highest industry PE Ratio i.e. 87.81, the Prataap Snacks share valuation comes to Rs. 419. It can be seen that the company has asked for more than double price. Further, the comparison of three companies is given hereunder;

The company operates under stiff competition with big players like PepsiCo, ITC, Parle Products, Balaji Wafers, Haldiram etc. The profit margin is very thin. PAT of revenue from operations is hardly 1% in Fiscal 2017. Further, noteworthy thing is that PAT has gone down substantially in Fiscal 2017 from Fiscal 2016.

Further, the company has not given financials for the quarter ended June 30,2017

Conclusion:

I read full 500 pager prospectus of every company coming with its IPO and write my reviews. Here, there is no need to write much on this. The company's financial are not strong enough to justify the price it has asked. AVOID

Thank you for reading....Jai Hind

CA Prashant Seta

(Disclaimer : I write reviews based on my knowledge and understanding. Investors should do their own research before applying IPO)

👍

ReplyDelete