Mahindra Logistics Limited IPO - Things to know

Mahindra Logistics Limited's promoter Mahindra & Mahindra Limited through its logistics division, Mahindra Logistics - undertook the business of providing logistics solutions, warehousing, freight forwarding and supply chain services (the "Logistics Business"). Pursuant to business transfer agreement between Mahindra Logistics Limited and its promoter, the entire logistics business was transferred to Mahindra logistics Limited. Since then, the logistics business has been undertaken by Mahindra Logistics Limited and its subsidiary companies.

Incorporated in August 2007, Mahindra Logistics has two subsidiaries namely 2 X 2 Logistics Private Limited (Incorporated in October 2012, 55% Shareholding) and Lords Freight (India) Pvt Ltd (Incorporated in April 2011, 60% of shareholding).

Mahindra Logistics Ltd IPO is opening on October 31,2017 and closing on November 2,2017. The tentative date of allotment is November 8,2017 and the allotment status can be seen on this link http://www.linkintime.co.in. The tentative date of listing is November 10,2017. The market lot is 34 shares and price range is Rs. 425 - Rs. 429.

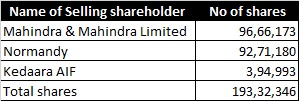

This IPO is 100% offer for sale. Existing shareholders are selling 1,93,32, 346 shares. The list of selling shareholders is given below;

Out of 1,93,32,346 shares, 1,25,000 shares are reserved for employees. Out of net 1,92,07,346, 35% is reserved for Retail Category

As it is 100% Offer For Sale arrangement, the company shall not receive any proceeds through IPO.

Mahindra Logistics Limited's competitive advantage is its "asset-light" business model pursuant to which assets necessary for its operations such as vehicles and warehouses are owned or provided by a large network of business partner. Its technology enabled, "asset light" business model allows for scalability of services as well as the flexibility to develop and offer customized logistics solutions across a diverse set of industries. It operates in two distinct business segments, SCM and PTS.

SCM (Supply Chain Management) business : It offers customised and end-to-end logistics solutions and services including transportation and distribution, warehousing, in-factory logistics and value added services to its clients. It operates its SCM business through a PAN - India network comprising 24 city offices and over 350 clients and operating locations as at August, 31,2017. It has a large network of over 1000 business partners providing vehicles, warehouses and other assets and services for its SCM business. As at August 31,2017, it managed over 1 crore square feet of warehousing spaces spread across its pan - India network of multiuser warehouses, built to suit warehouses, stockyards, network hubs and cross docks. As at August 31,2017, it operated in factory stores and line-feed at over 35 manufacturing locations. Its "asset light" business model along with its solutions design capabilities enables it to served over 200 domestic and multinational companies operating in several industry verticals in India including automotive, engineering, consumer goods, pharmaceuticals, e-commerce and bulk. It has sourced and developed its customised technology systems in order to provide innovative and cost-efficient solutions and to improve transparency and visibility for its clients.

Certain key clients of its SCM business include Valkwagen India Private Limited, Vodafone India Limited, Thermax Limited, JSW Steel Limited, Ashok Leyland Limited, Siemens Limited, Bosch Limited, BMW India Private Limited, 3M India Limited, and Mercedeze-Benz India Private Limited.

PTS (People Transport Service) business: It provides technology-enabled people transportation solutions and services across India to over 100 domestic and multinational companies operating in the IT, ITes, business process outsourcing, fnancial services, consulting and manufacturing industries. It offers its services through the feet of vehicles provided by a large network of over 500 business partners. As at August 31,2017, it operated its PTS business in 12 Cities and over 120 clients and operating locations across India.

Certain key clients in India for its PTS business include Tech Mahindra Limited, AXISCADES Engineering Technologies Limited and ANZ Support Services India Private Limited.

For Fiscal 2017, Revenue from SCM was 88.94% and PTS was 11.06%.

Profitability: Logistic sectoe is very unorganised sector in India. Organised companies are very few and Mahindra Logistics Limited is one of them. However, there is no monopoly whatsover. The company is faces too much competitition against domestic unorganised players. The company operates at very thin margin, hardly 1.72%. The trend of past five years profit margin is given;

(Rs In Cr)

The company and its operations depends significantly on its parent and promoter, Mahindra and Mahindra Limited and the other Mahindra Group Entities. Entities within Mahindra Group together constituted 53.96% of its revenue from operations for the Fiscal 2017.

RoNW (Return on Net worth) : The company has RoNW hardly 13.11% for Fiscal 2017.

PE (Price Earning) Multiple: The latest EPS (Dilluted and on consolidated basis) for Fiscal 2017 was Rs. 6.62. The trend for the past five years is given below;

The company has set price range between Rs. 425 - Rs. 429 per share. At lower and upper price band, PE Multiple comes between 64.19 - 64.90 The selling shareholders are asking the price which is too high, RoNW is not impressive neither PAT percentage. Further, it is an offer for sale. The company will not receive any money to further expand the business which can increase its PAT and RoNW. Its both subsidiaries are making losses. The cost of acquisition of shares of Mahindra & Mahindra Limited is Rs. 10, and for other two Rs. 122.29. Why selling shareholders are charging the premium too high? Well, there are no listed peers to compare the statistics with.

PB Multiple (Book value) : The latest book value (on consolidated basis) of Share for fiscal 2017 was Rs. 51.13. The trend for the last five years was given below;

At lower and upper price band, PB Multiple comes between 8.31 to 8.39. Again, expensive.

Mahindra Logistics Ltd IPO is opening on October 31,2017 and closing on November 2,2017. The tentative date of allotment is November 8,2017 and the allotment status can be seen on this link http://www.linkintime.co.in. The tentative date of listing is November 10,2017. The market lot is 34 shares and price range is Rs. 425 - Rs. 429.

This IPO is 100% offer for sale. Existing shareholders are selling 1,93,32, 346 shares. The list of selling shareholders is given below;

As it is 100% Offer For Sale arrangement, the company shall not receive any proceeds through IPO.

Mahindra Logistics Limited's competitive advantage is its "asset-light" business model pursuant to which assets necessary for its operations such as vehicles and warehouses are owned or provided by a large network of business partner. Its technology enabled, "asset light" business model allows for scalability of services as well as the flexibility to develop and offer customized logistics solutions across a diverse set of industries. It operates in two distinct business segments, SCM and PTS.

SCM (Supply Chain Management) business : It offers customised and end-to-end logistics solutions and services including transportation and distribution, warehousing, in-factory logistics and value added services to its clients. It operates its SCM business through a PAN - India network comprising 24 city offices and over 350 clients and operating locations as at August, 31,2017. It has a large network of over 1000 business partners providing vehicles, warehouses and other assets and services for its SCM business. As at August 31,2017, it managed over 1 crore square feet of warehousing spaces spread across its pan - India network of multiuser warehouses, built to suit warehouses, stockyards, network hubs and cross docks. As at August 31,2017, it operated in factory stores and line-feed at over 35 manufacturing locations. Its "asset light" business model along with its solutions design capabilities enables it to served over 200 domestic and multinational companies operating in several industry verticals in India including automotive, engineering, consumer goods, pharmaceuticals, e-commerce and bulk. It has sourced and developed its customised technology systems in order to provide innovative and cost-efficient solutions and to improve transparency and visibility for its clients.

Certain key clients of its SCM business include Valkwagen India Private Limited, Vodafone India Limited, Thermax Limited, JSW Steel Limited, Ashok Leyland Limited, Siemens Limited, Bosch Limited, BMW India Private Limited, 3M India Limited, and Mercedeze-Benz India Private Limited.

PTS (People Transport Service) business: It provides technology-enabled people transportation solutions and services across India to over 100 domestic and multinational companies operating in the IT, ITes, business process outsourcing, fnancial services, consulting and manufacturing industries. It offers its services through the feet of vehicles provided by a large network of over 500 business partners. As at August 31,2017, it operated its PTS business in 12 Cities and over 120 clients and operating locations across India.

Certain key clients in India for its PTS business include Tech Mahindra Limited, AXISCADES Engineering Technologies Limited and ANZ Support Services India Private Limited.

For Fiscal 2017, Revenue from SCM was 88.94% and PTS was 11.06%.

Profitability: Logistic sectoe is very unorganised sector in India. Organised companies are very few and Mahindra Logistics Limited is one of them. However, there is no monopoly whatsover. The company is faces too much competitition against domestic unorganised players. The company operates at very thin margin, hardly 1.72%. The trend of past five years profit margin is given;

(Rs In Cr)

The company and its operations depends significantly on its parent and promoter, Mahindra and Mahindra Limited and the other Mahindra Group Entities. Entities within Mahindra Group together constituted 53.96% of its revenue from operations for the Fiscal 2017.

RoNW (Return on Net worth) : The company has RoNW hardly 13.11% for Fiscal 2017.

PE (Price Earning) Multiple: The latest EPS (Dilluted and on consolidated basis) for Fiscal 2017 was Rs. 6.62. The trend for the past five years is given below;

The company has set price range between Rs. 425 - Rs. 429 per share. At lower and upper price band, PE Multiple comes between 64.19 - 64.90 The selling shareholders are asking the price which is too high, RoNW is not impressive neither PAT percentage. Further, it is an offer for sale. The company will not receive any money to further expand the business which can increase its PAT and RoNW. Its both subsidiaries are making losses. The cost of acquisition of shares of Mahindra & Mahindra Limited is Rs. 10, and for other two Rs. 122.29. Why selling shareholders are charging the premium too high? Well, there are no listed peers to compare the statistics with.

PB Multiple (Book value) : The latest book value (on consolidated basis) of Share for fiscal 2017 was Rs. 51.13. The trend for the last five years was given below;

At lower and upper price band, PB Multiple comes between 8.31 to 8.39. Again, expensive.

The company operates in a highly fragmented and competitive industry and increased competition may lead to a reduction in its revenues, reduced profit margins or a loss of market share. As the nature of its business requires, Mahindra Logistics keeps too much dependency on business partners which adversely affect their business.

The company has many competitive strenghts like

An "asset-light" business model which allows flexibility and scalability in operations and high capital efficiency

Customised, technology driven logistics solutions

Integrated, end-to-end logistics services and solutions

The Mahindra Brand and support from the Mahindra Group

Presence across diverse industry verticals with long-standing client relationships

Experienced management team with strong domain expertise

Conclusion:

NEUTRAL. The company has many strenghts, however, it is expensive. Selling shareholders are not leaving much on the plate for investors.

Thank you for reading...Jai Hind

CA Prashant Seta

Hello Your blog is very Informative, I like it so such, thanks for sharing the such information........

ReplyDeleteLogistics Services Gauteng

Thank you...:)

Delete