MAS Financial Services Limited - Should you subscribe?

MAS Financial Service Limited has come up with its IPO two days after Godrej Agrovet Limited hits the primary market and a day before Indian Energy Exchange Limited is going to open (Sat-Sun ignored).

MAS IPO is opening on October 6, 2017 and closing on October 10,2017. The tentative dates of allotment and listing are October 16, 2017 and October 18,2017 respectively. The allotment details can be available on this link http://www.linkintime.co.in.

Recently, listing of iconic IPOs viz ICICI Lombard and SBI Life Insurance have failed to give expected listing gains to their investors. ICICI Lombard listed with Rs. 10 discount and SBI Life Insurance listed with meagre 5% (Rs.35) premium above its offer price. At the end, it closed at Rs. 707. The gain was as equal as peanut. Both companies are fundamentally strong backed by prominent promoters and growth prospect, however, they did not leave much on investors plates from the beginning itself. Both cash rich companies shares were already overpriced. Lesser known company Prataap Snacks (Diamond) had far better subscription figures than ICICI Lombard and SBI Life Insurance, though Prataap Snacks share was expensive too. Let us see the fate on the listing day.

Well, MAS Financial Services Limited IPO is mix of offer for sale and fresh issue. The company will garner Rs. 233 Crore through fresh issue while existing shareholders namely; DEG (Deutsche Investitions - und Entwicklungsgesellschaft MBH), FMO (Nederlandse Financiering - Maatschappij voor Ontwikkelingslanden NV) and Sarva Capital LLC shall sell shares worth Rs. 227 Crore. Promoters and promoter groups are not selling their single shares.

The company shall not receive any proceeds from Offer For Sale. The company proposes to utilise the net proceeds from the fresh issue towards augmenting its capital base to meet future capital requirements.

MAS Financial Service is a Gujarat based NBFC (Non - banking finance corporation) with more than two decades of business operations and as of June 30,2017, the company operated across six states and NCT of Delhi. Its business and financing products are primarily focussed on middle and low income customer segments, and include five principal categories ; (I) Micro Enterprise loans; (II) SME Loans; (III) two wheeler loans; (IV) Commercial vehicle loans (which include new and used commercial vehicle loans, used car loans and tractor loans; (V) housing loans

In addition to its own sales team, the company has entered into commercial arrangements with a large number of sourcing intermediaries, including commission based DSAs (Direct Sales Agents) and revenue sharing arrangements with various dealers and distributors where part of loan default is guaranteed by such sourcing partners. As of June 30,2017, the company had 322 such sourcing intermediaries for its two wheeler loan segment and 395 such sourcing intermediaries for its commercial vehicle loan segment. As of June 30,2017, the company has entered into arrangements with 55 sourcing intermediaries for its housing loan segment who typically are affordable housing project developers and property agents.

A significant part of its business origination in various segment is represented by loan extended to MFIs(Micro Finance Institutions), HFCs (Housing Finance Corporations) and other NBFCs (Non - Baking Finance Corporations) that provide financing products including micro enterprise loans, SME loans, Commercial Vehicle Loans, Two wheeler loans and housing loans enabling the company to have a geographical reach extending beyond its direct customer locations. As of June 30,2017 it has extended loans to 98 such financial institutions. As of June 30,2017, 1816.70 Crore which represented 52.16% of its AUM related to loans extended to other financial institutions.

By virtue of access to low cost funds and an extensive branch network, banks compete with NBFCs, especially on the cost front. However, with their strategic presence in lending segments as well as geographies, NBFCs have carved out a niche for themselves to effectively compete with banks. The niche products focus of NBFCs enable them to make customized offerings. Currently, NBFCs dominate construction equipment finance while they are slowly gaining market share in housing, loan against property and microfinance. In emerging segments such as small and medium enterprise finance and wholesale finance, NBFCs have doubled their market share in the past five years even though it is still at a lower level. Low penetration in Tier II and Tier III cities, product and process innovations, and continued focus on core business will be the key enablers for steady growth.

Should you subscribe? YES for medium - long term.

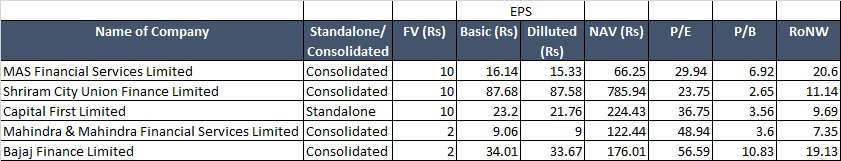

If we compare with NAV (Rs. 66.25 as on March 31,2017 on consolidated basis) to price band Rs. 456 - Rs. 459, it is evident that offer price is 6.88 - 6.92 times of NAV which is much higher than Shriram City Union Finance Limited (2.65 times), Capital First Limited (3.56 times) and Mahindra & Mahindra (3.6 times). Bajaj Finance is little expensive (10.83 times). So, from P/B front MAS Financial share is expensive.

The positive point of MAS Financial service is its RoNW. 20.60% Return on Net worth of MAS Financial services is highest among its competitors followed by Bajaj Finance 19.13%, Shriram City Union Finance 11.14%. Capital First limited and Mahindra & Mahindra have less than 10% RoNW i.e. 9.69% and 7.35% respectively. The comparison summary is given below;

MAS Financial Service Limited's Revenue from operations and PAT has witnessed consistent growth over the years. The company's total revenue increased at a CAGR of 26.35% from Rs. 143.12 Crore in Fiscal 2013 to 364.70 Crore in Fiscal 2017 while its PAT increased at a CAGR of 25.87% from Rs 27.31 Crore in Fiscal 2013 to Rs. 68.56 Crore in Fiscal 2017. However, profit margin has remained stagnant.

As of June 30,2017, the company has more than 500000 active loan accounts across more than 3165 customer locations in six states and the NCT of Delhi, served through its 121 branches. The company's AUM (Assets Under Management) increased at a CAGR of 33.37% from Rs. 1053.19 Crore as on March 31,2013 to Rs. 3325.57 as on March 31,2017

The company's NPA is very negligible. As of March 31,2017 and June 30,2017, company's Gross NPA was Rs. 35.27 Crore and 39.2 Crore respectively while Net NPA was 30.55 Crore, and 33.05 Crore respectively. The Gross NPA as a percentage of its AUM was 1.06% and 1.14% respectively as of such dates.

For financing company, the growth of AUM (Assets Under Management) plays a vital role in the success of the company. Higher the AUM, higher the revenue from operations. Company's AUM has increased at a CAGR of 33.37% from 1053.19 Crore from March 31,2013 to 3332.57 Crore in March 31,2017. Its return on average AUM was 3.16% in March 31,2013 to 2.34% in March 31,2017.

As an NBFC, MAS Financial Service is subject to regulations relating to the capital adequacy, which determine the minimum amount of capita it must hold as a percentage of the risk-weighted assets on its portfolio and of the risk adjusted value of off-balance sheet items, as applicable. Under RBI's Non-Banking Financial (Non - deposit accepting or holding) Companies Prudential Norms (Reserve Bank) Direction,2007, as amended from time to time, an NBFC is required to have a regulatory minimum CRAR of 15%. As on June 30,2017, company's CRAR was 23.80% on a stand alone basis of which Tier I capital was 18.52%.

Apart from financial figures, company has other competitive strengths such as track record of consistent growth with quality loan portfolio, no complicated corporate structure, diversified product offerings presenting significant growth opportunities, access to diversified sources of capital and cost - effective funding, deep market knowledge through extensive sourcing channels, robust credit assessment and risk management framework, experienced management team with reputed investors. The company's strategies are to strengthen marketing and sourcing channel along with maintaining stable growth and without compromising quality of portfolio, to expand product offerings, leveraging existing network and customer base to develop housing finance business, leveraging technology to foster growth etc.

Due to monetization effect, the projected growth of NBFCs was impacted in Fiscal 2017 and MAS Financial service was no exception. However, it will gain the momentum from Fiscal 2018 onwards. MAS Financial Service Limited's Return on Average net worth flat fell from 27.77% in Fiscal 2016 to 20.65% in Fiscal 2017. It will recover slowly and gradually. It is noteworthy here that RoNW is still highest among its competitors.

MAS Financial Service is a Gujarat based NBFC (Non - banking finance corporation) with more than two decades of business operations and as of June 30,2017, the company operated across six states and NCT of Delhi. Its business and financing products are primarily focussed on middle and low income customer segments, and include five principal categories ; (I) Micro Enterprise loans; (II) SME Loans; (III) two wheeler loans; (IV) Commercial vehicle loans (which include new and used commercial vehicle loans, used car loans and tractor loans; (V) housing loans

In addition to its own sales team, the company has entered into commercial arrangements with a large number of sourcing intermediaries, including commission based DSAs (Direct Sales Agents) and revenue sharing arrangements with various dealers and distributors where part of loan default is guaranteed by such sourcing partners. As of June 30,2017, the company had 322 such sourcing intermediaries for its two wheeler loan segment and 395 such sourcing intermediaries for its commercial vehicle loan segment. As of June 30,2017, the company has entered into arrangements with 55 sourcing intermediaries for its housing loan segment who typically are affordable housing project developers and property agents.

A significant part of its business origination in various segment is represented by loan extended to MFIs(Micro Finance Institutions), HFCs (Housing Finance Corporations) and other NBFCs (Non - Baking Finance Corporations) that provide financing products including micro enterprise loans, SME loans, Commercial Vehicle Loans, Two wheeler loans and housing loans enabling the company to have a geographical reach extending beyond its direct customer locations. As of June 30,2017 it has extended loans to 98 such financial institutions. As of June 30,2017, 1816.70 Crore which represented 52.16% of its AUM related to loans extended to other financial institutions.

By virtue of access to low cost funds and an extensive branch network, banks compete with NBFCs, especially on the cost front. However, with their strategic presence in lending segments as well as geographies, NBFCs have carved out a niche for themselves to effectively compete with banks. The niche products focus of NBFCs enable them to make customized offerings. Currently, NBFCs dominate construction equipment finance while they are slowly gaining market share in housing, loan against property and microfinance. In emerging segments such as small and medium enterprise finance and wholesale finance, NBFCs have doubled their market share in the past five years even though it is still at a lower level. Low penetration in Tier II and Tier III cities, product and process innovations, and continued focus on core business will be the key enablers for steady growth.

Should you subscribe? YES for medium - long term.

The company has set price range between Rs. 456 - Rs. 459 per share. EPS (Dilluted) for the year ended March 31,2017 was Rs. 15.33 on consolidated basis. If lower - higher price band is taken, PE Multiple ranges between 29.74 - 29.94. Industry highest, lowest and average PE Multiple is 56.59, 23.75 and 41.51 respectively. From PE Multiple front, MAS Financial share is cheaper than its competitors Bajaj Finance (PE 56.59), Mahindra & Mahindra (PE 48.94), Capital First Limited (PE 36.75) . On the other hand, it is slightly expensive than its competitor Shriram City Union Finance Limited (PE 23.75).

If we compare with NAV (Rs. 66.25 as on March 31,2017 on consolidated basis) to price band Rs. 456 - Rs. 459, it is evident that offer price is 6.88 - 6.92 times of NAV which is much higher than Shriram City Union Finance Limited (2.65 times), Capital First Limited (3.56 times) and Mahindra & Mahindra (3.6 times). Bajaj Finance is little expensive (10.83 times). So, from P/B front MAS Financial share is expensive.

The positive point of MAS Financial service is its RoNW. 20.60% Return on Net worth of MAS Financial services is highest among its competitors followed by Bajaj Finance 19.13%, Shriram City Union Finance 11.14%. Capital First limited and Mahindra & Mahindra have less than 10% RoNW i.e. 9.69% and 7.35% respectively. The comparison summary is given below;

MAS Financial Service Limited's Revenue from operations and PAT has witnessed consistent growth over the years. The company's total revenue increased at a CAGR of 26.35% from Rs. 143.12 Crore in Fiscal 2013 to 364.70 Crore in Fiscal 2017 while its PAT increased at a CAGR of 25.87% from Rs 27.31 Crore in Fiscal 2013 to Rs. 68.56 Crore in Fiscal 2017. However, profit margin has remained stagnant.

As of June 30,2017, the company has more than 500000 active loan accounts across more than 3165 customer locations in six states and the NCT of Delhi, served through its 121 branches. The company's AUM (Assets Under Management) increased at a CAGR of 33.37% from Rs. 1053.19 Crore as on March 31,2013 to Rs. 3325.57 as on March 31,2017

The company's NPA is very negligible. As of March 31,2017 and June 30,2017, company's Gross NPA was Rs. 35.27 Crore and 39.2 Crore respectively while Net NPA was 30.55 Crore, and 33.05 Crore respectively. The Gross NPA as a percentage of its AUM was 1.06% and 1.14% respectively as of such dates.

For financing company, the growth of AUM (Assets Under Management) plays a vital role in the success of the company. Higher the AUM, higher the revenue from operations. Company's AUM has increased at a CAGR of 33.37% from 1053.19 Crore from March 31,2013 to 3332.57 Crore in March 31,2017. Its return on average AUM was 3.16% in March 31,2013 to 2.34% in March 31,2017.

As an NBFC, MAS Financial Service is subject to regulations relating to the capital adequacy, which determine the minimum amount of capita it must hold as a percentage of the risk-weighted assets on its portfolio and of the risk adjusted value of off-balance sheet items, as applicable. Under RBI's Non-Banking Financial (Non - deposit accepting or holding) Companies Prudential Norms (Reserve Bank) Direction,2007, as amended from time to time, an NBFC is required to have a regulatory minimum CRAR of 15%. As on June 30,2017, company's CRAR was 23.80% on a stand alone basis of which Tier I capital was 18.52%.

Apart from financial figures, company has other competitive strengths such as track record of consistent growth with quality loan portfolio, no complicated corporate structure, diversified product offerings presenting significant growth opportunities, access to diversified sources of capital and cost - effective funding, deep market knowledge through extensive sourcing channels, robust credit assessment and risk management framework, experienced management team with reputed investors. The company's strategies are to strengthen marketing and sourcing channel along with maintaining stable growth and without compromising quality of portfolio, to expand product offerings, leveraging existing network and customer base to develop housing finance business, leveraging technology to foster growth etc.

Due to monetization effect, the projected growth of NBFCs was impacted in Fiscal 2017 and MAS Financial service was no exception. However, it will gain the momentum from Fiscal 2018 onwards. MAS Financial Service Limited's Return on Average net worth flat fell from 27.77% in Fiscal 2016 to 20.65% in Fiscal 2017. It will recover slowly and gradually. It is noteworthy here that RoNW is still highest among its competitors.

Conclusion :

By and large, the IPO seems good. Promoters being Gujaratis, you cannot doubt their excellence. Moreover, they run this business over two decades. However, financing business is always risky. Even a small version of Vijay Malya type borrower can destroy the company's performance phenomenally. As seen, company plays safe to lend money to MFs, HFCs and NBFCs to mitigate such risks.

Bye for now....happy investing

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer : I've opined based on my knowledge and understanding. Investors should do their own research before applying)

Nice Article! Thanks for sharing such a valuable information. Balmer Lawrie & Co. Ltd.

ReplyDeleteBalmer Lawrie Investments Limited

Balrampur Chini Mills Limited

Balurghat Technologies Limited