Reliance Nippon Life Asset Management Limited IPO - Should you subscribe?

Once upon the time, there was an investor who had turned beggar. One day he didn't manage to collect sufficient money by begging, so he decided to loot somebody. On fine early morning, he waited in middle of the empty road.

Then one man passed by, and the investor turned beggar stopped him and said, "I am a ducait, give me your money else I will hurt you".

Then one man passed by, and the investor turned beggar stopped him and said, "I am a ducait, give me your money else I will hurt you".

The man smiled and said, "Do you know who am I?"

The beggar said, "No".

The man said, "I am Anil Ambani, ADAG Group Chairman"

The beggar said, "Oh..you are Anil Ambani. Then not your money but give me back my money. I invested in Reliance Power"

The average cost of acquisition per share by selling shareholders namely Reliance Capital and Nippon Life were Rs. 8 and Rs. 115 respectively.

RoNW (Return on Net worth) was not impressive. It was on decreasing trend. As on March 31,2017, RoNW was 21% which went down from 22% as of March 31,2016 and 23% as of March 31, 2015. Profit margin was 37% as of March 31,2015 which went down to 30% as of March 31, 2016 and 28% as of March 31,2017. Detailed financials are not properly scanned in Red Herring Prospectus filed to ROC and SEBI.

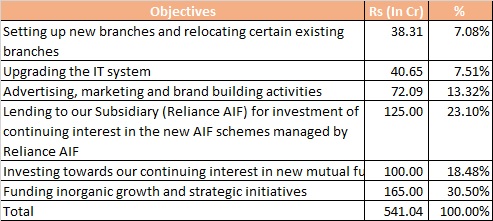

Out of total proceeds of Rs. 1542.24 Crore approximately, the company shall receive only 40% i.e. 616.90 Crore approx. The remaining 60% being proceeds by offer for sale, the company shall not received any money. The company proposes to utilise the net proceeds for the following objectives (The break up of Rs. 541.04 Crore is given, balance Rs. 75.85 Crore may be for other corporate expenses and issue expenses) :

The beggar said, "No".

The man said, "I am Anil Ambani, ADAG Group Chairman"

The beggar said, "Oh..you are Anil Ambani. Then not your money but give me back my money. I invested in Reliance Power"

The investor turned beggar had applied the iconic Reliance Power IPO in January 2008. There were many who turned beggar after the fiasco of Reliance Power IPO, the first biggest IPO of the history of Indian Capital Market, Rs. 11,563 Crore.

After 9 years and 9 months, ADAG Group's yet another IPO is coming in the last week of October,2017. The issue is opening on October 25,2017 and closing on October 27,2017.

The IPO is combination of Fresh Issue and Offer for sale, total number of shares under IPO arrangement are 6,12,00,000. Existing shareholders shall sell shares upto 3,67,20,000 and the company shall give 2,44,80,000 as fresh issue. 35% is reserved for Retail Investors.

Should you subscribe?

Already, investors have lost confidence in ADAG Group company and top of that the company has over priced its shares under the IPO . The company has set price range between Rs. 247 - Rs. 252 per share. The EPS (Diluted on Consolidated basis) as on March 31,2017 was Rs. 6.85 per share. At the lower and higher price band, PE Multiple comes in between 36.05 - 36.79. There is no listed peer ,so exact comparison can not be made. However, prima facie, asset management companies shares are risky to acquire at 36.79 PE Multiple. It is better to invest in Reliance Mutual Fund rather than its AMC Reliance Nippon Life Asset Management Limited.

For a moment, if we keep aside PE Multiple and look at the price from PB (Book value Multiple) front, then also share is quite expensive. The book value per share (On consolidated basis) was Rs. 28.10 as on June 30,2017. If we take lower and higher price band, the company has asked the price which is ranging between 8.79 times to 8.97 times of its book value.

After 9 years and 9 months, ADAG Group's yet another IPO is coming in the last week of October,2017. The issue is opening on October 25,2017 and closing on October 27,2017.

The IPO is combination of Fresh Issue and Offer for sale, total number of shares under IPO arrangement are 6,12,00,000. Existing shareholders shall sell shares upto 3,67,20,000 and the company shall give 2,44,80,000 as fresh issue. 35% is reserved for Retail Investors.

Should you subscribe?

Already, investors have lost confidence in ADAG Group company and top of that the company has over priced its shares under the IPO . The company has set price range between Rs. 247 - Rs. 252 per share. The EPS (Diluted on Consolidated basis) as on March 31,2017 was Rs. 6.85 per share. At the lower and higher price band, PE Multiple comes in between 36.05 - 36.79. There is no listed peer ,so exact comparison can not be made. However, prima facie, asset management companies shares are risky to acquire at 36.79 PE Multiple. It is better to invest in Reliance Mutual Fund rather than its AMC Reliance Nippon Life Asset Management Limited.

For a moment, if we keep aside PE Multiple and look at the price from PB (Book value Multiple) front, then also share is quite expensive. The book value per share (On consolidated basis) was Rs. 28.10 as on June 30,2017. If we take lower and higher price band, the company has asked the price which is ranging between 8.79 times to 8.97 times of its book value.

The average cost of acquisition per share by selling shareholders namely Reliance Capital and Nippon Life were Rs. 8 and Rs. 115 respectively.

RoNW (Return on Net worth) was not impressive. It was on decreasing trend. As on March 31,2017, RoNW was 21% which went down from 22% as of March 31,2016 and 23% as of March 31, 2015. Profit margin was 37% as of March 31,2015 which went down to 30% as of March 31, 2016 and 28% as of March 31,2017. Detailed financials are not properly scanned in Red Herring Prospectus filed to ROC and SEBI.

Out of total proceeds of Rs. 1542.24 Crore approximately, the company shall receive only 40% i.e. 616.90 Crore approx. The remaining 60% being proceeds by offer for sale, the company shall not received any money. The company proposes to utilise the net proceeds for the following objectives (The break up of Rs. 541.04 Crore is given, balance Rs. 75.85 Crore may be for other corporate expenses and issue expenses) :

Though objective of utilisation of net proceeds from fresh issue seems impressive, yet it seems expensive share.

The company operates under severe market competition. The company is exposed to significant market risk that could impair the value of its investment portfolio and adversely affect the business and result of operations. AUM and the future of the fund management industry is dependent on the performance of the Indian economy and security market.

Conclusion:

There is no doubt that Mutual Fund industry has grown in recent past and the trend will continue further. MFs are giving returns as equal as or more than equity and consistent return. Every other day, new Mutual Fund scheme is introduced by any of existing AMCs. Investors have gained confidence in Mutual Fund. However, this IPO should be avoided as the share is Expensive. I would recommend to invest in Reliance Mutual Fund than to invest in its AMC Reliance Nippon Life Asset Management Limited.

There is no doubt that Mutual Fund industry has grown in recent past and the trend will continue further. MFs are giving returns as equal as or more than equity and consistent return. Every other day, new Mutual Fund scheme is introduced by any of existing AMCs. Investors have gained confidence in Mutual Fund. However, this IPO should be avoided as the share is Expensive. I would recommend to invest in Reliance Mutual Fund than to invest in its AMC Reliance Nippon Life Asset Management Limited.

Thank you for reading...Jai Hind

CA Prashant Seta

(Disclaimer : I write review based on my knowledge and understanding. Investors should do their own research before applying)

CA Prashant Seta

(Disclaimer : I write review based on my knowledge and understanding. Investors should do their own research before applying)

Comments

Post a Comment